The holiday period is a crucial time for the wine and spirits industry, and recent market data sheds some light on consumer spending patterns and behavior. These insights are key for brands in the sector to strategically position their products and marketing efforts for maximum impact during the festive season.

Growth in spending and opportunities

In their 2023 Holiday Retail Survey, Deloitte Insights anticipates a notable 14% rise in overall holiday spending compared to the previous year. This increase is expected despite anticipated higher costs in food and beverages as a result of inflation.

That said, wine and spirits are not favored equally by modern buyers—wine consumption is on the decline across various age groups, with the most significant drop observed among Gen Z. According to Nielsen IQ data, there was a 5.2 percent decrease in wine sales over a 52-week period ending in March 2022.

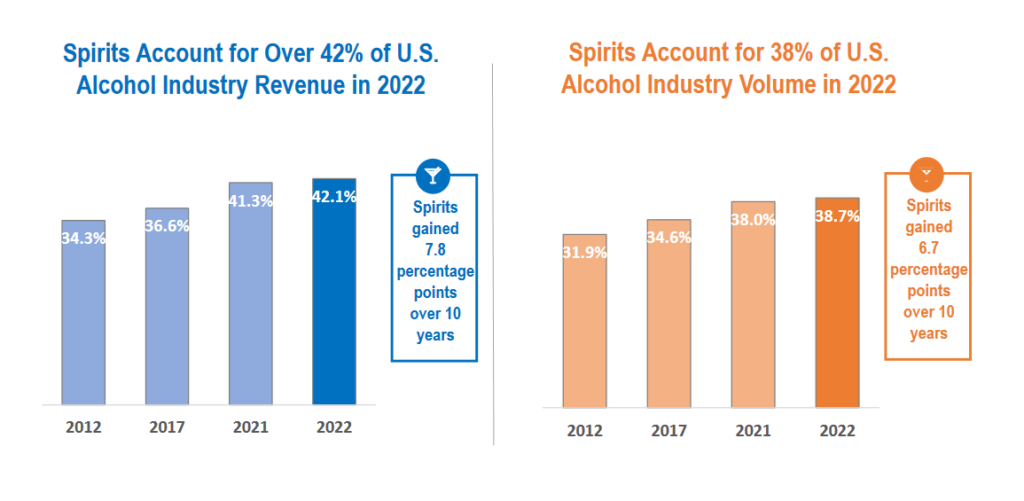

Contrarily, the U.S. witnessed a record market share for distilled spirits in 2022, as reported by the Distilled Spirits Council of the United States (DISCUS). This growth translated into a 5.1% increase in sales, reaching a record $37.6 billion, and a 4.8% rise in volume, totaling 305 million 9-liter cases.

The substantial growth in this sector was predominantly fueled by whiskey and tequila. Whiskey sales soared by 10.5% to $5.1 billion, while tequila witnessed an even more impressive growth of 17.2%, reaching $3.1 billion.

Source: Distilled Spirits Council of the United States, Annual Economic Briefing

Gifting: a core focus

As one would expect, gifting accounts for a non-negligible portion of holiday wine spending. Survey data from Civic Science reveals that as many as 40% of Americans are likely to buy wine as a gift this holiday season.

To be more specific, during the 2022 holiday quarter, Drizly saw an increase in wine gifts, especially red and sparkling wines, with wine and liquor gifts outpacing standard orders. Average prices for liquor, wine, and beer also rose during this period, underscoring a shift in consumer purchasing behavior towards early and diversified shopping for holidays.

Targeting the affluent demographic

The wine and spirits industry has been witnessing a rapid growth in premiumization across all categories, and this trend is particularly apparent during the holidays when consumers tend to be more indulgent with their spending.

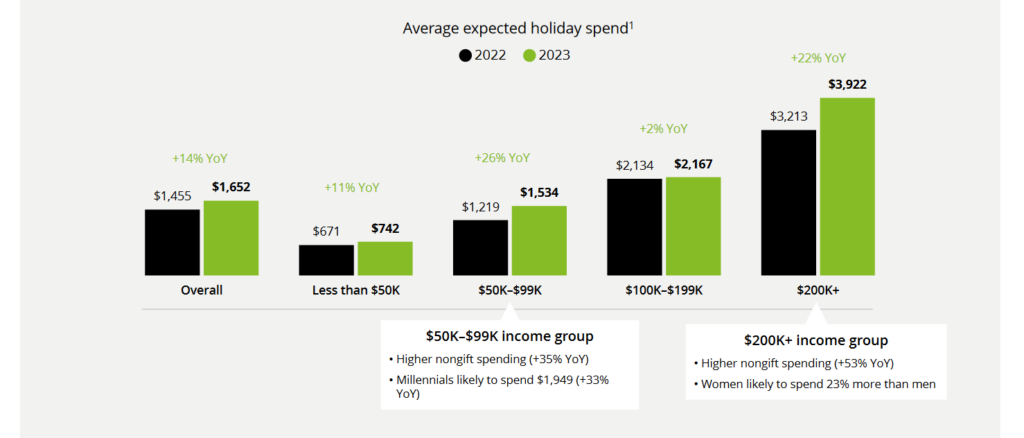

In particular, high-income households—those earning above $200,000 annually—are forecasted to boost their holiday spending by 22% year-over-year, according to Deloitte . They are expected to spend nearly 22% more than the last holiday season, making them a prime target for ultra-premium and luxury wine and spirits brands. Early engagement, before October’s end, is crucial to tap into this group’s spending plans.

According to Chris Williams, Executive Vice President of National Accounts at Southern Glazer’s Wine & Spirits, 33% of Americans spent over $50 on a bottle of alcohol in 2022, compared to 24% in 2021. This shift towards premium products is expected to persist, particularly in the wine segment, where the $15-$24.99 price range is showing growth.

Source: Deloitte Insights, 2023 Deloitte Holiday Retail Survey

The rise of self-gifting

Interestingly, Deloitte also found that consumers aren’t just buying gifts for their friends and family, but themselves as well. As many as 75% of shoppers are considering purchasing gifts for themselves.

The idea of treating oneself to a more-premium beverage option first gained popularity during the pandemic, where consumers sought out luxurious experience that they could bring into the home. Now, it appears self-gifting may be here to stay.

This trend opens a new avenue for brands to promote their premium products not just as gifts for others but as self-indulgences.

E-commerce and social media

This year’s holiday season is set to be more digital and diversified than prior years, with 63% of shoppers planning to conduct at least some of their holiday shopping online. Wine and spirits brands need to offer intuitive browsing, one-click checkout options, and flexible delivery and pick-up in order to remain competitive in the digital age.

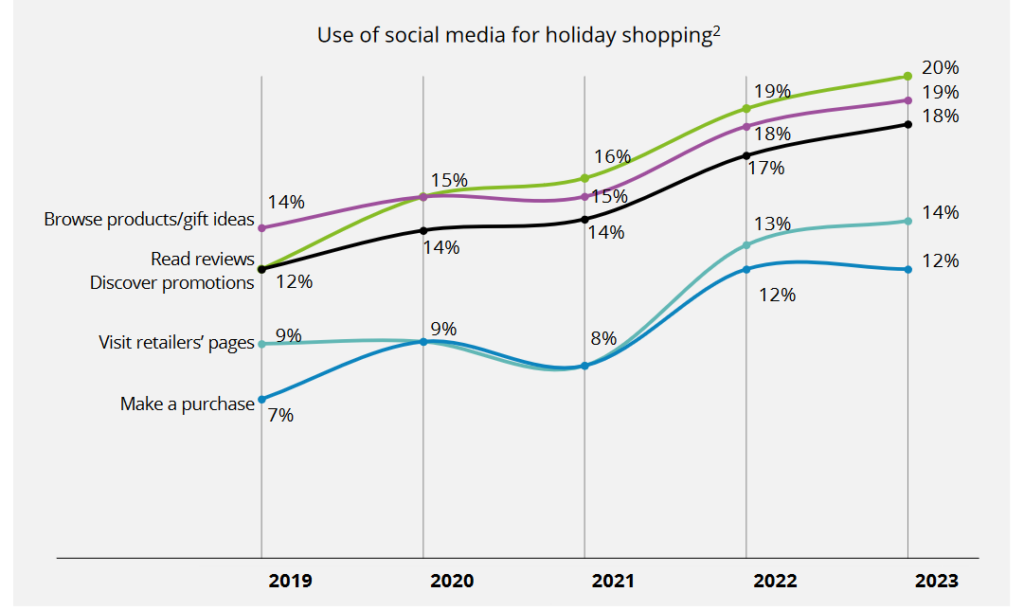

Additionally, more and more consumers are turning to social media to aid in their holiday shopping, whether it be just brainstorming ideas and browsing products, or actively seeking out promotions and even making a purchase.

Source: Deloitte Insights, 2023 Deloitte Holiday Retail Survey

Making the most of this holiday season

The upcoming holiday season presents a significant opportunity for the wine and spirits industry to capitalize on changing consumer behaviors and spending patterns. With a projected surge in overall holiday spending and a discernible shift towards premiumization, brands must strategically align their marketing and sales efforts to cater to these trends.

Additionally, the rise of self-gifting and the increasing importance of e-commerce and social media strategies signal a need for brands to innovate and adapt. By understanding and leveraging these market dynamics, wine and spirits businesses can position themselves for a prosperous and buoyant festive season.

Happy holidays!

- How Spirits Brands Can Improve Brand Loyalty with Data Analytics - January 30, 2024

- The Collapse of Herbl, and How Other Cannabis Distributors Can Avoid the Same Fate - January 24, 2024

- Top 5 Blog Posts of 2023 - December 28, 2023