The whiskey market has been witnessing robust growth in recent years, with whiskey leading spirits sales in the US at a whopping $12.5 billion in sales in 2022, up 5.9% from the year before. Several key factors are driving the sales of whiskey worldwide, and understanding these dynamics can help industry stakeholders and enthusiasts make informed decisions. Let’s delve into what’s fueling this growth.

The bourbon boom

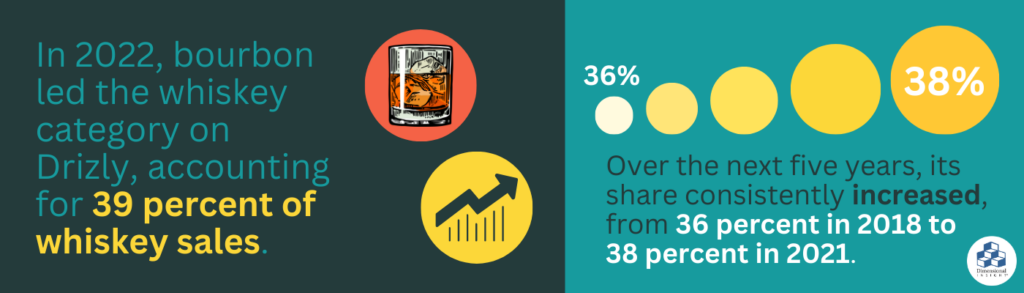

Bourbon has always been a beloved spirit, but its popularity has been skyrocketing in recent years. In 2022, bourbon led the whiskey category on Drizly, accounting for 39 percent of whiskey sales. Over the preceding five years, its share consistently increased, from 36 percent in 2018 to 38 percent in 2021. Canadian whisky was the only other whiskey subcategory to increase its market share in the past year.

According to BevAlc Insights, the demand for bourbon is expected to continue to grow, driven by a primarily younger, more diverse audience. Additionally, bourbon tourism is on the rise, with more people visiting distilleries and participating in bourbon tastings and experiences.

Premiumization

Consumers are increasingly seeking out premium products across all categories, and whiskey is no exception. Whiskey tends to be more expensive than other spirits categories already, and a renewed interest from Americans for American whiskies has caused the category to take off. High-end, aged whiskies, and limited-edition releases are particularly popular within the growing consumer base.

Premium products provide an opportunity for consumers to engage with the story and heritage behind the brand. The experience of enjoying a premium-crafted spirit becomes a social currency, allowing consumers to share their passion and sophistication with others (especially on social media).

Smaller, independent craft distilleries are leading the charge with products that encapsulate their story as well as highlight their craftsmanship. For example, some brands are experimenting with different cask finishes such as rum, wine, and exotic wood in order to develop new flavors.

Japanese whiskey

While Japanese whiskey constitutes a modest (yet expanding) portion of total whiskey sales, there are several reasons why this category warrants particular attention.

According to BevAlc Insights, Japanese whiskey’s share of the total whiskey category on Drizly rose by 13 percent (from 3.8 percent last year to 4.3 percent share in 2021 to date). Moreover, the average unit price of Japanese whisky on Drizly rose to $79.38 in 2021 to date, up from $74.66 during the same period in 2020. This increase places Japanese whisky even more firmly in the luxury spirits domain, as the average whiskey unit price on Drizly in 2021 to date stands at $36.72.

Part of Japanese whiskey’s success can be attributed to its appeal to younger (Gen Z) consumers, who are in general more likely to experiment with food and drinks from other cultures. Additionally, it’s perception as a “luxury” option also cemented its position as the most gifted whiskey category in the Untied States last year.

Craft cocktails

The demand for premium beverages can also be seen on-premise as consumers seek to replicate the same flashy dinks they’ve seen on TikTok and Instagram. The advent of social media and viral marketing has introduced a certain degree of showmanship to consumer expectations.

Bartenders are now pushing the boundaries of creativity by innovating on traditional whiskey cocktails. Classic recipes, such as the Old Fashioned and Whiskey Sour are being reinvented with a modern twist. Mixologists are experimenting with a variety of unique ingredients, from exotic fruits and spices to house-made syrups and bitters. Techniques such as fat-washing, infusing the whiskey with different flavors, and using smoked ice cubes are also being employed to add depth and complexity to the drinks.

Additionally, there is a growing trend towards low-alcohol and non-alcoholic whiskey cocktails, as consumers seek out healthier options.

Learn more

Interested in learning more about what’s going in the spirits industry? Check out our white paper—”5 Trends Impacting the Wine & Spirits Industry in 2023.”

- How Spirits Brands Can Improve Brand Loyalty with Data Analytics - January 30, 2024

- The Collapse of Herbl, and How Other Cannabis Distributors Can Avoid the Same Fate - January 24, 2024

- Top 5 Blog Posts of 2023 - December 28, 2023