With shifting consumer preferences and a heightened focus on health and wellness, the demand for alternatives to traditional alcoholic beverages has soared. The low/no-alcohol sector has started to gain traction both domestically and abroad, offering an array of enticing options from zero-alcohol beers and spirits to low-alcohol wines and mocktails.

The category’s sudden success reflects an evolving consumer base, with suppliers innovating new products in an attempt to break into previously untapped revenue streams. However, despite its growth, there are still major barriers to wider adoption of low/no-alcohol beverages. Understanding the market’s long-term sustainability will require continued monitoring as new consumer trends emerge.

The market is growing—fast

The low/no-alcohol beverage industry is experiencing a rapid expansion within the US, with sales reaching a whopping $395 million between August 2021 and August 2022, according to research from NielsenIQ.

The market can roughly be broken down into three categories:

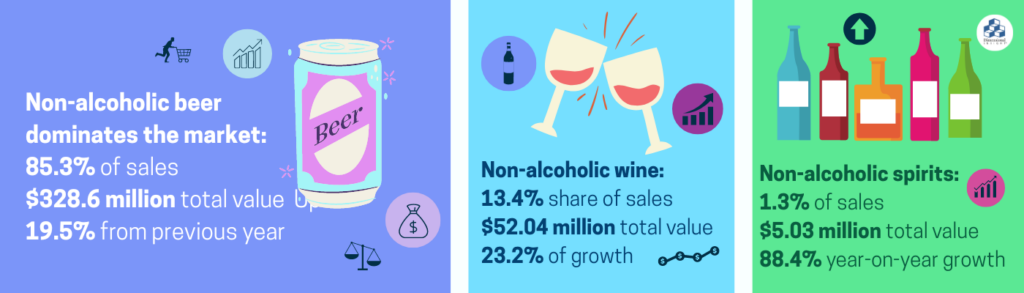

- Non-alcoholic beer dominates the market, accounting for 85.3% of sales and reaching a value of $328.6 million, marking a substantial increase of 19.5% compared to the previous year.

- Non-alcoholic wine holds a 13.4% share of sales, valued at $52.04 million, with a remarkable growth rate of 23.2%.

- Non-alcoholic spirits make up 1.3% of sales, amounting to $5.03 million, showing a significant year-on-year growth of 88.4%.

Motivating factors

Following in the footsteps of the hard seltzer craze, low/no-alcohol beverages have emerged largely as a result of increased demand for healthier drinking options, especially within the Gen Z and millennial demographic.

More health conscious and open to trying new experiences than prior generations, Gen Z and millennial consumers have driven a major societal shift in how people experience and consume alcohol. This change in social perception has encouraged consumers to explore low- and no-alcohol alternatives without the risk of feeling alienated by their friends and family.

Likewise, social media has provided a unique opportunity for brands to gain exposure and visibility within new consumer bases. The increased popularity of platforms like TikTok has driven an influx of consumers seeking to recreate cocktail trends and recipes from their favorite influencers.

What does this mean for suppliers?

According to Solene Marchand, the head of marketing for Pernod Ricard’s non-alcoholic product line, the majority of their consumers are individuals who already consume alcohol, but are now seeking to reduce their intake.

“We know that 71% of the consumers of these new non-alcoholic spirits also consume alcoholic spirits,” says Marchand. “So, that’s really interesting for the way we communicate to our consumers.”

Marchand emphasizes the importance of not straying too far from the familiar world of alcoholic drinks to ensure consumer recognition and acceptance. By maintaining similarities in packaging, serving style (such as using a spirits bottle and double measure), and adhering to established norms, brands can facilitate consumer understanding and encourage trial of non-alcoholic offerings.

Barriers to growth

Compared to traditional alcoholic beverages, low/no-alcohol products often suffer from limited awareness and visibility. Many consumers are unaware of the range of options available to them, and accessing these products can be challenging, especially in certain geographic areas.

Furthermore, the on-premise sector, including bars, restaurants, and social venues, has been relatively slow to adopt many low/no-alcohol options. Factors such as limited demand perception, concerns over profitability, and a lack of consumer education contribute to the hesitancy in offering a comprehensive selection.

Regulatory frameworks around alcohol can also pose significant barriers to the growth of low/no-alcohol beverages. These regulations vary across countries and regions, often imposing strict labeling requirements or making it difficult to market low/no-alcohol products effectively. In the US and UK, beverages are required to be less than 0.05% ABV to be considered alcohol-free, whereas in the EU the limit is much more flexible at 0.5% ABV.

Learn more

The low/no alcohol category appears to have a promising future, but this trajectory can only be maintained by diligently monitoring consumer behavior and ensuring that both products and their marketing efforts reflect these trends.

Curious about what else is trending in the wine and spirits industry? Check out our white paper—”5 Trends Impacting the Wine & Spirits Industry in 2023.”

- How Spirits Brands Can Improve Brand Loyalty with Data Analytics - January 30, 2024

- The Collapse of Herbl, and How Other Cannabis Distributors Can Avoid the Same Fate - January 24, 2024

- Top 5 Blog Posts of 2023 - December 28, 2023