In the fast-paced world of wine & spirits, data drives decisions. And among the myriad types of data, there’s none that suppliers request from their distributors more than RAD (retail account data) and depletion data. But, are distributors consistent in providing this data?

What is RAD and depletion data?

RAD, or retail account data, refers to data reflecting sales directly into the retail level. This data provides insights into how specific products are selling in different retail locations.

Depletion data refers to the quantity of product that has been “depleted” from a distributor’s inventory. Normally it represents products that have left the distributors’ warehouses. Note the key word is ‘normally’. Read on to learn about caveats that suppliers need to keep in mind when making decisions based on depletion data.

The problem with depletion data

Suppliers want distributors to update depletion data continually. However, some distributors face challenges in keeping up-to-date with real-time closing balances. Rather than providing dynamic updates, some distributors can only report monthly updates while others can report daily. Even the definition of what counts as a depletion varies between distributors. Some distributors include breakage, samples, returns, etc., while others do not. These inconsistencies pose hurdles for businesses aiming to understand their current operational landscape.

If a supplier wants to view the big picture for a single product regardless of which distributor sold it, they need a way to make the product codes the same regardless of what code the distributor assigns to it. I.e. making inconsistent codes consistent. Normally suppliers outsource this task because it is a tremendous amount of work, but the result enables valuable trend analysis.

RAD vs depletion data

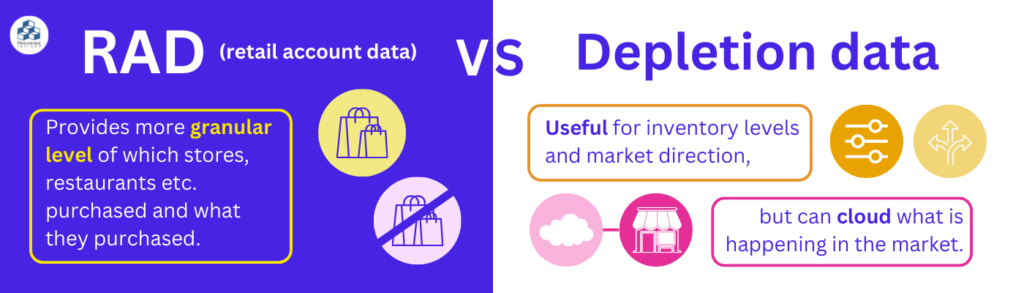

Depletion data, while useful for inventory levels and market direction, can cloud what is happening in the market. If depletions include volume for a new product that is offering free bottle samples as a promotion, it is less reflective of actual purchases than RAD would be since RAD reflects actual store purchases.

RAD provides the more granular level of which stores, restaurants etc. purchased and what they purchased. This is great information to have, but it has the same issue as the distributor provided product data….each distributor creates their own codes. Because of this, it is difficult for a supplier to identify sales into a chain of stores or restaurants across the country. Once again, the inconsistent codes need to be made consistent. However, the extra work provide the ability for suppliers to get a bigger picture of how products are performing in chains and stores.

Depletion reporting can be useful when it comes to inventory management. Since depletions can include ‘everything that left the warehouse’, it reflects true inventory better than RAD. This helps to better forecast inventory needs. Suppliers can anticipate which products might need to be replaced soon, ensuring that popular items are always available, while also minimizing the overstock of slower-moving goods.

Lastly, RAD data’s relative immediacy proves invaluable when detecting anomalies. Any unusual spikes or dips in sales can be quickly identified. Recognizing these anomalies without delay means businesses can quickly take corrective actions. Whether that’s addressing potential supply chain disruptions, recalibrating marketing campaigns, or merely rectifying data entry errors, the quick turnaround can save both time and money.

Making the most of your data

Distributor data reporting poses a variety of different challenges that can make it difficult for suppliers to see the big picture. Gaining an accurate (and up-to-date) bird’s eye view of your sales and supply chain requires a solution that can not only unify multiple disparate data sources, but also provides the standardization necessary to make that data usable. The solution? Supplier Advisor.

Built on the award-winning Diver Platform, Supplier Advisor allows businesses to improve product and account management, as well as capitalize on growth opportunities with up-to-date access to information about depletions, shipments, and sales. But don’t just take our word for it—check out real-world success stories from our customers.

- How Spirits Brands Can Improve Brand Loyalty with Data Analytics - January 30, 2024

- The Collapse of Herbl, and How Other Cannabis Distributors Can Avoid the Same Fate - January 24, 2024

- Top 5 Blog Posts of 2023 - December 28, 2023