During the summer of 2019, whether you were at the beach, a bar, or a baseball game, you were likely to spot people in the crowd with White Claws in their hands.

Through the years, sales of hard seltzer have ebbed and flowed. But, as this summer approaches, sales are high, and it seems we might have upon us another “White Claw summer,” as 2019 was dubbed by YouTuber Trevor Wallace.

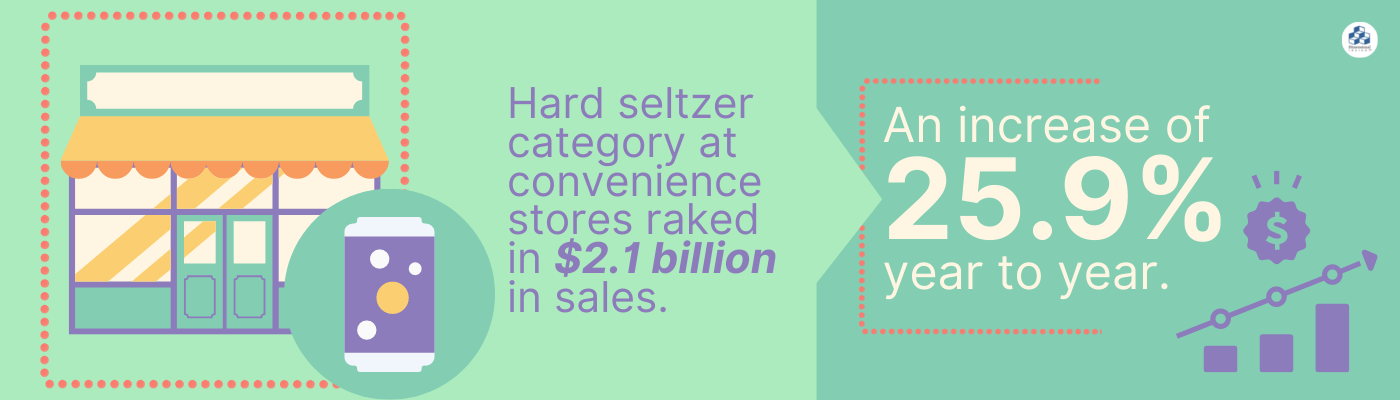

According to IRI Worldwide, the hard seltzer category at convenience stores raked in $2.1 billion in sales, an increase of 25.9% year to year.

As the temperatures heat up, customers are reaching for old favorites, like White Claws, but also want to try new, novelty ready-to-drink (RTD) cocktails. For producers, this means slowly expanding some existing lines and allowing the entry of new products with caution…and some great marketing.

“Single-serve cans will explode in volume this year,” Bump Williams, the founder, president, and CEO of Bump Williams Consulting in Shelton, Connecticut, told CStoreDecisions.

“Old Faithful”

Customers want a brand they trust and a taste they know they love. White Claw remains “old faithful” for customers wanting a canned drink.

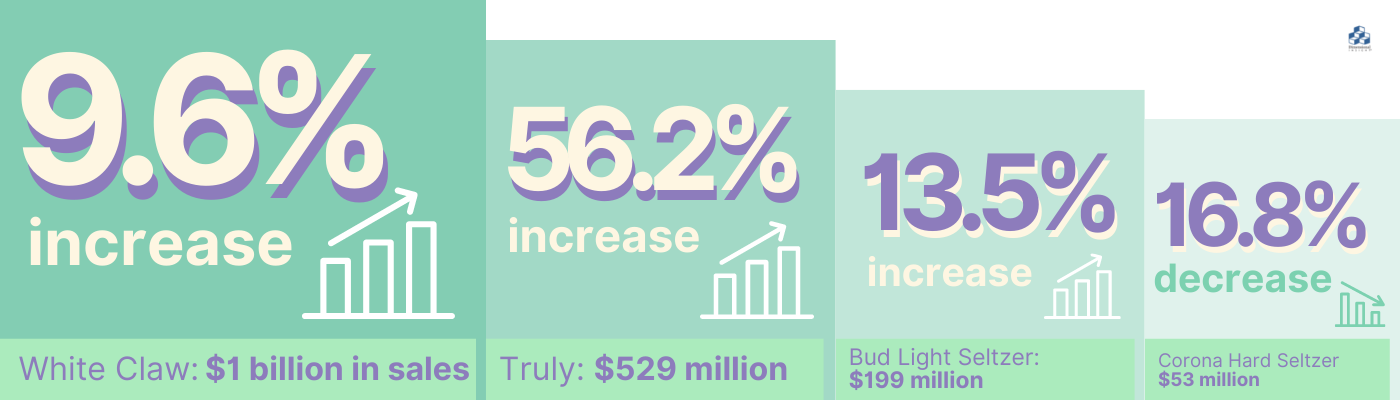

In 2021, White Claw reached $1 billion in sales, up 9.6% from the year before. Truly ranked second in sales at $529 million, a 56.2% gain. Bud Light Seltzer recorded sales of $199 million, a jump of 13.5%. In 4th place, Corona Hard Seltzer was almost $53 million in sales, which was down 16.8%.

Ready for something new

Topping White Claw may seem like a far-fetched dream for some brands, but customers seem ready to try something new when the product matches their values and their taste buds.

Within that RTD cocktail category, sales were slightly over $167 million, a dramatic 62.4% rise.

“Canned cocktails are a convenient and quality solution for cocktail lovers,” Earl Kight, the co-founder and chief sales and marketing officer for Cutwater Spirits, told Drizly. “No ingredients, no prep or clean-up. They offer controlled ABVs and consistently taste delicious.”

Betches, a media known for its witty commentary and social media posts, released its first RTD cocktail brand last month, Faux Pas. Betches created the drink line with the help of Spirit of Gallo, an alcohol company also behind High Noon Hard Seltzer and Pink Whitney Vodka.

View this post on Instagram

Betches’ three female founders are banking on its online community of 48 million people, largely millennial and Gen Z women, which aligns with a key demographic of the canned cocktail market.

Buyers of canned cocktails tend to skew female and younger, as women make up 60% of buyers. Of those consumers, 62% are millennials, followed only by Gen Z, which makes up 23% of the market.

The RTD cocktail segment currently seems small compared to established spirits. Still, it is expected to swell and reach between $3 billion and $4 billion in revenue in coming years, per Bank of America Securities’ forecast.

How data can help producers make new line extensions

For producers, the increase in hard seltzer and canned cocktail sales can provide a proof point that the market wants easy, delicious drinks in a can.

New products can be welcomed, but they must be novel or product extensions that make sense.

“Be selective on any and all new products and line extensions,” Williams warned. “Ask the question, ‘Where will these volumes be coming from? Brand switching or incremental business?'”

Gen Z remains the largest untapped market with the most potential for canned cocktails producers. Social media, especially TikTok, can unleash the uncapped market potential by targeting them where they’re at.

- 87% of Utilities Have Experienced at Least One Data Breach in Last Three Years - February 5, 2024

- Can Drones Lower Your Next Utility Bill? - January 10, 2024

- Onshore Wind Farms Are The Next Big Thing In Renewable Energy - December 6, 2023