Making their entrance in the market only six years ago, RTD (ready-to-drink) cocktails have grown to become one of alcohol’s biggest success stories. The combination of convenience, wide flavor variety, and appeal to younger demographics has allowed RTD cocktails to grow 226 percent in sales from 2016 to 2021, according to data from Mintel.

With this in mind, many businesses are hoping to cash in on the RTD craze with their own canned cocktail—but creating a record-setting beverage is easier said than done. To fully capitalize on the potential of the growing RTD market, businesses have to make sure they’re using the right formula for success.

Correct market positioning

Generally speaking, customers are picking RTD cocktails from store shelves for two primary reasons—they act as either a healthier alternative to other beverage options, or their higher proof serves as a replacement for those missing the bar experience. Regardless of which category a cocktail fits into, the end result is the same—premiumization.

Over the past few years, millennial purchasing trends have driven a strong demand for health-conscious beverage options, specifically those that are low-alc or low-calorie. As a result, RTD cocktails that cater to this new “healthy living” craze are starting to dip into the traditional beer and mixed drink consumer base. Also competing for this demographic are hard seltzer companies like Truly and Whiteclaw, which have cemented themselves as the go-to option for those looking for lighter beverage options. This means that in order to establish a strong footing in the current market, RTD cocktail brands have to emphasize their market advantages, such as no artificial sweeteners or only organic ingredients.

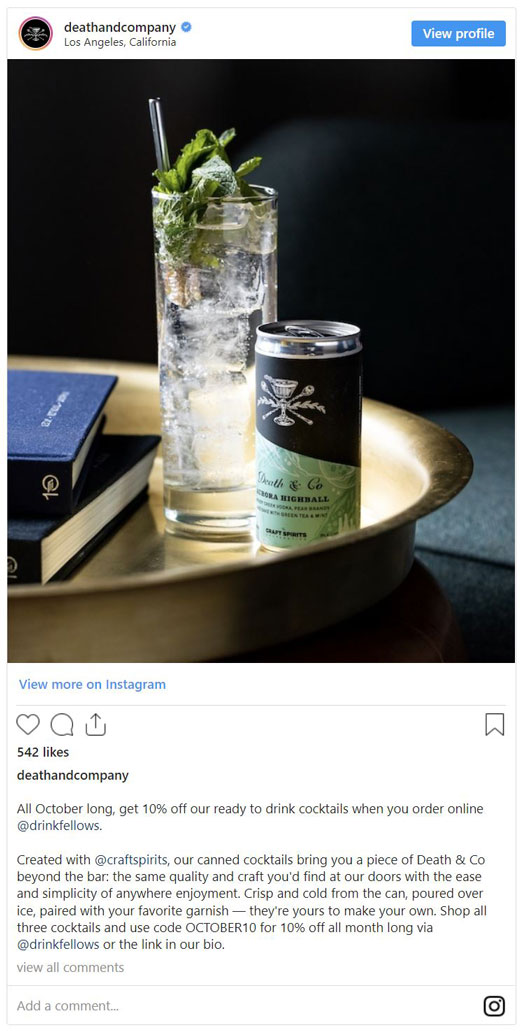

Likewise, millennials’ desire for a more “authentic” drinking experience provides distilleries with a unique opportunity to occupy a niche that beer and hard seltzers struggle to gain traction in. Premium ingredients and higher ABV allow consumers to replicate the experience they’d have on-premise, all from the comfort of their couch. This has also opened up an opportunity for smaller brands to enter the market with craft products by capitalizing on the recent interest in local flavors and small-batch producers.

Choosing the right base

Unlike seltzers and beer, RTD cocktails have a range of options for choosing their alcohol base, each of which provides its own flavor, ABV, cost, and calories. These options can be divided into sugar brew, malt, spirits, and wine.

Although alcohol laws differ from state to state, malt- and sugar-based beverages are generally permitted at grocery stores, opening up a much broader range of retail opportunities than just wine and liquor stores. Additionally, malt and sugar brew tend to be the most cost-effective options available, making production significantly cheaper. As an added bonus, sugar brew is naturally gluten-free and has a neutral flavor.

However, it’s difficult to create an authentic-tasting vodka-soda or gin and tonic without using actual vodka or gin. This is where spirits begin to shine. An RTD cocktail utilizing genuine spirits allows for a far more premium end-product and typically lends itself to better marketing for businesses looking to capitalize on the demand for higher-quality beverages. That said, true spirits are often more expensive and can be subject to stricter laws and regulations.

Though less popular than the above options, wine has also witnessed some success as a base within the RTD market. Which wine (and harvest) you use can have a dramatic effect on the end-product’s color and flavor, lending it to customers who consider themselves more “drink-savvy” than your average consumer. However, like spirits, using wine as a base can have greater legal and tax implications.

The right packaging

As they are drawn to most markets experiencing premiumization, consumers are also drawn to products with packaging that reflects their superior-quality contents. This means that if your drink is all about catering to the health craze of the millennial demographic, then your packaging must look the part. Consumers looking for a classier or healthier beverage aren’t likely to go for the drink with neon colors or comic-style lettering (looking at you, Four Loko). The importance of appropriate branding has only grown amidst the rise of the younger demographic.

Additionally, while RTD cocktails have become almost synonymous with canned packaging due to its versatility, they are by no means the only option. Other forms of packaging, such as Tetra Pak, provide the same convenience as cans while also providing a more environmentally-friendly alternative, further catering to the millennial demand for brands who practice sustainable business practices. Cartons also have the added benefit of being resealable if consumers don’t feel like finishing their drink in one sitting.

So you think you’ve found the winning formula—what’s next?

The moral of the story here is to know your targeted demographic and have a strong game-plan before entering the market. The RTD cocktail segment is loaded with potential for innovative and forward-thinking brands, but going in blind will yield little more than stagnant shelves and overstocked warehouses. So, the question is, how do businesses gain visibility into such a competitive market?

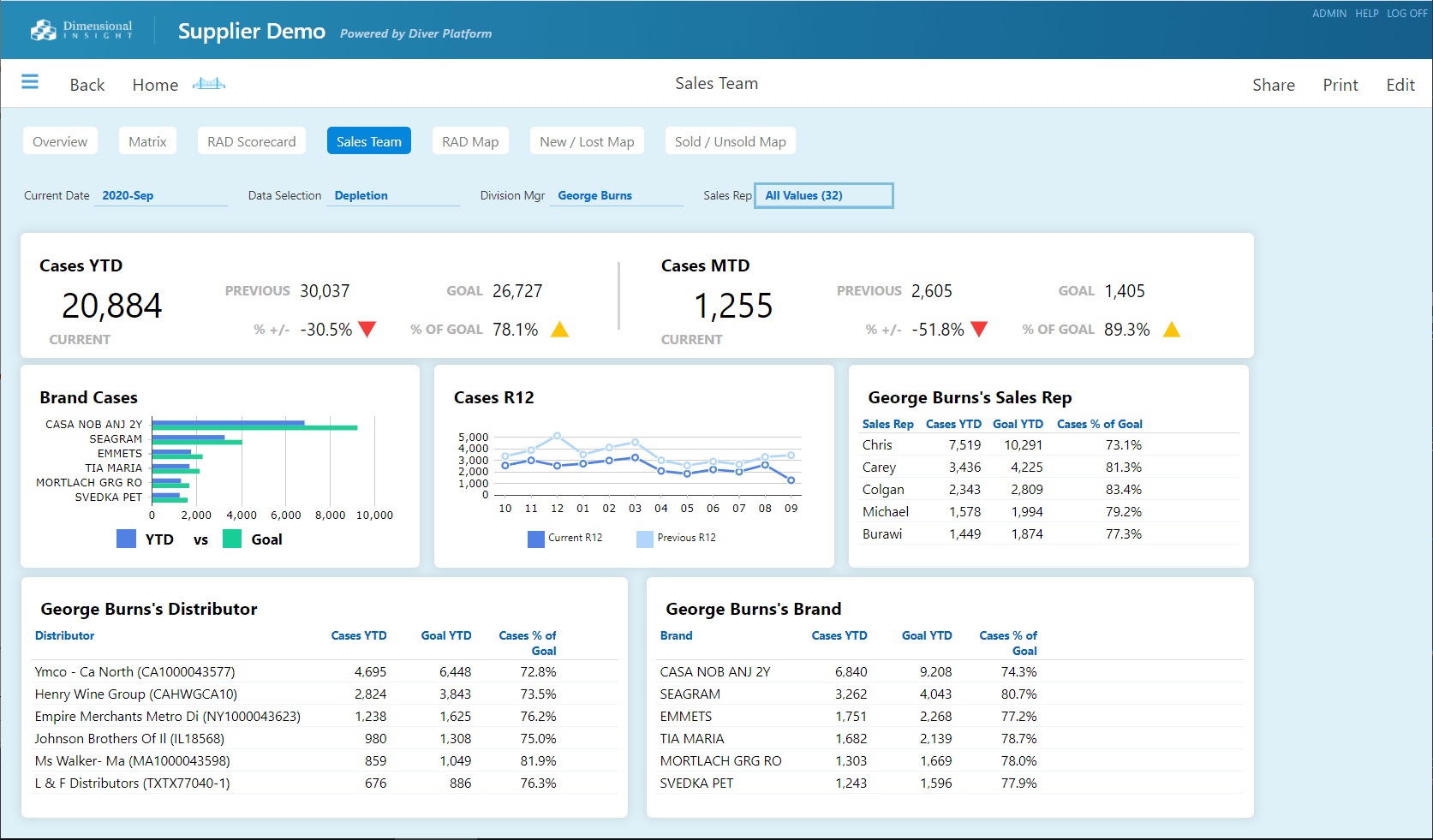

The solution lies in your data. With the right analytics platform, you can view marketing, sales, and inventory data all from one central location to determine what’s working and what’s not, and why. Perhaps a specific marketing campaign has brought in an influx of new customers, or maybe a newly released flavor just didn’t hit the mark, but you won’t know for sure until you look at the data.

The best way to ensure your business is investing your time and resources in the right place is by working with an analytics solution that doesn’t just know the industry, but knows how to succeed in it.

Sample dashboard generated with Dimensional Insight’s Supplier Advisor.

- How Spirits Brands Can Improve Brand Loyalty with Data Analytics - January 30, 2024

- The Collapse of Herbl, and How Other Cannabis Distributors Can Avoid the Same Fate - January 24, 2024

- Top 5 Blog Posts of 2023 - December 28, 2023