Traditional thinkers may envision a solid investment as a house, stocks, or a fine piece of art.

But the “cool kids” know the best investments are fine wine, crypto, and even rare comics.

Cult Wine Investment released The Alternative Wealth Report and found a “new breed of investors want to feel engaged by more than financial reward unlike their predecessors and seek out items that are cooler than the average investment.”

According to the report, fine wine has increased 127% in value on average in the last 10 years.

In addition to wine, 47% of millennial millionaires have at least 25% of their wealth in cryptocurrencies. The cool kid, or ‘identity investor,’ also likes NFTs.

“It’s a way to signal you are a web native person,” Ajit Tripathi, an angel investor in crypto, told Bloomberg. “You are one of the cool kids.”

Bidding for wine

When the pandemic first started, businesses and restaurants closed, leaving wine lovers searching for a digital option to purchase their vino.

“The pandemic has really accelerated the digital transformation of wine as a product, as a category, and now as a safe bet asset,” Cult Wine Investment co-founder and CEO Tom Gearing said in the report.

“The investor’s desire for assets has evolved; imminent financial reward is no longer a dominant motivator, rather, it is personal passions driving diversification within asset classes. We’re seeing emerging investors come to us through their love of a region or grape, but also with an expectation to experience it as they have other asset classes.”

Sotheby’s latest wine auction, “Icons Only | The Best of Burgundy & Bordeaux,” sold 144 lots with 1,206 bottles of wine. The total auction sales closed at a staggering $2.39 million. The closing sales tallied 58% higher than the high-end pre-sale estimate of $1.51 million.

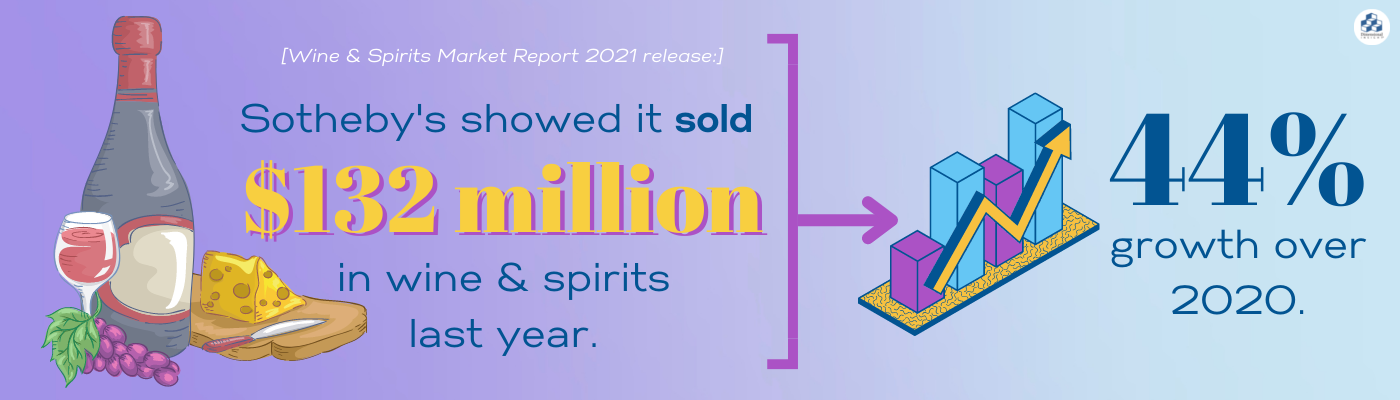

Sotheby’s, known for its prestigious wine sales, released its Wine & Spirits Market Report 2021, showing it sold $132 million in wine and spirits last year, a 44% growth over 2020.

How this data can help the wine industry

The data shows wine is having a banner year. The analytics can help forecast trends and what the “cool kids” want most from their investments.

According to Cult Wine’s website, the last 30 years are proof that fine wine is one of the best-performing assets, with a compound annual growth rate of 10%. Wine is also a tangible asset that has a scarcity factor because of limited release vintages.

Wine brands can use this to their advantage by touting to the average customer — or new potential investors — that their product is more than a drink. It’s a statement. An investment in wine isn’t just about financial return, it’s about exclusivity and the “cool” factor.

According to the Alternative Wealth Report, “It’s a profound shift in attitudes, experiences, and expectations that’s given birth to an entirely new investor phenomenon: the Identity Investor.”

- 87% of Utilities Have Experienced at Least One Data Breach in Last Three Years - February 5, 2024

- Can Drones Lower Your Next Utility Bill? - January 10, 2024

- Onshore Wind Farms Are The Next Big Thing In Renewable Energy - December 6, 2023