In times of economic turmoil, the wine and spirits industry has typically been one of the most resilient sectors. Even now, with the COVID-19 pandemic ravaging the U.S. economy, sales of alcoholic beverages remain strong. However, that is not to say that the pandemic hasn’t had some profound and unexpected effects on sales.

Although it’s already been said ad-nauseum, these truly are unprecedented times. As such, sticking to current methods, or basing decisions on what worked in the past, is a recipe for failure. The best way to quickly determine what is going on, and how to respond, is to follow the data.

How the beverage industry responds to typical recessions

Ordinarily, recessions tend to affect what people are drinking, but have a much less pronounced effect on the quantity. In other words, the total amount of alcoholic drinks that people consume remains relatively unchanged during economic downturns. However, the drinks that people tend to buy during recessions are unsurprisingly cheaper, since people have less money to spend. Super premium liquors tend to take an especially large hit. Combined, these trends usually result in marginally lower profits overall for beverage producers and distributors.

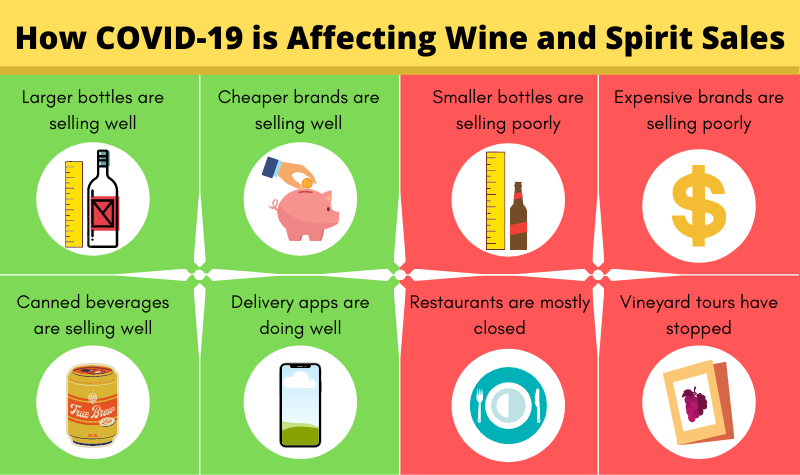

So far during the COVID-19 pandemic, the usual trend of people buying lower-priced liquors holds true. In fact, the trend is even more pronounced since people aren’t going out to restaurants as much, or buying expensive bottles of wine as party gifts.

How data shows us that this time is different

While the shift towards less expensive brands remains the same, other trends that have emerged in the past few months are quite surprising.

There was a dramatic spike in beverage sales near the end of March, when there were widespread concerns that stores might be closed down. Since then, the rate of sales has lowered significantly, but still remains well above its average level from previous years. The total amount that people are drinking seems to be much higher during the pandemic than it has been during previous recessions. People seem to be going to liquor stores less often, but buying larger amounts when they do. This is supported by the fact that larger bottles, especially ‘handles’ sold in 1.75-liter quantities, are seeing more sales, while fewer people are buying small bottles.

The products seeing the most astonishing increases in sales are not bottles at all, but cans. Canned wines and cocktails have been steadily rising in popularity for a while now, but during the pandemic, that popularity has skyrocketed. In the week ending with March 21, canned wine and cocktails saw incredible 95% and 93% increases in sales. It seems that many customers who miss getting cocktails at local bars and restaurants are willing to settle for the canned alternative for the time being.

Beer sales received surprisingly modest gains compared to other beverages. The considerable 42% boost they saw in March dwindled down to a mere 11% by mid-June, according to Nielsen. In the same time period, wine sales have gone from an initial increase of 66% over the previous year, down to a more reasonable 20%.

As of June, spirits sales are still up by 25% over where they were in 2019, with tequila leading the pack, closely followed by gin. Vodka’s common role as a ‘party drink’ may be slowing it down during social distancing.

Of course, alcohol delivery apps, which were already skyrocketing, are reaching even greater heights now that people are cautious about leaving their homes. Drizly, one of the biggest names in home delivery for alcohol, saw a 300% increase in sales. On-premise sales were almost completely wiped out, but are starting to recover as more restaurants with outdoor seating start to reopen.

Conclusion

The pandemic seems to be affecting every business differently, with some companies prospering while others struggle to stay afloat. Current and accurate data has become more vital than ever in order to quickly determine what business practices are working and which aren’t, so that decision-makers can react accordingly.

For distributors, keeping up with changes in demand is crucial to success. Knowing which brands perform best is how distribution companies can gain a competitive edge, and that knowledge comes from analytics. For now, canned wine and spirits, tequila, and home delivery services are the biggest winners, but in these times of constant uncertainty, that could change at any time. The only way to stay ahead of these changes is through careful observation of data.

- The CBMTA is Here to Stay! Here’s Why That’s Good for Craft Brewers - January 6, 2021

- High-End Liquor Sales are Recovering Slowly - November 10, 2020

- How to Reach New Customers in 2021 - November 5, 2020