Data plays a huge role in all aspects of a cannabis business. Besides the day-to-day business decisions for which companies in any industry use data, there are trends that apply specifically to the world of cannabis.

Some of those trends are universal, reflecting overall cannabis use. A lot of them, though, are state-specific, since marijuana is illegal at the federal level and each state has its own regulations regarding the substance. Here’s a look at how some of those laws in a couple of states have an impact, and how analytics can help companies make the most of it.

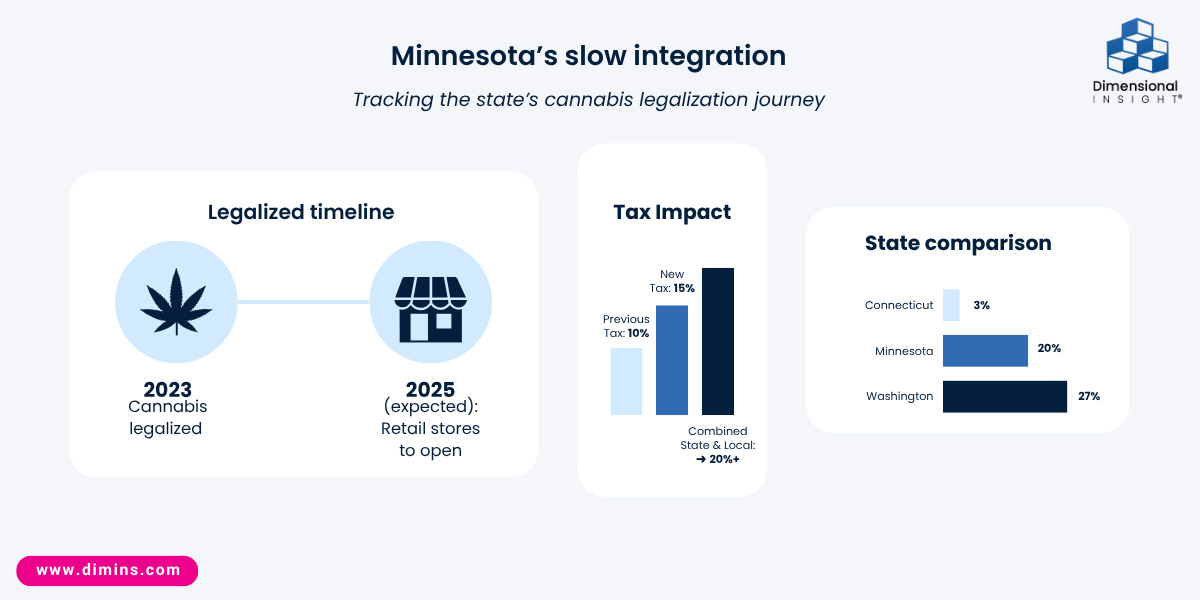

Minnesota’s slow integration

Minnesota is an interesting case when it comes to the legalization process. The state legalized cannabis in 2023, with the hope that retail licenses would allow stores to open in 2025. So far, those stores have not opened, but state leaders still hope to see that happen before the end of the year. The situation is complicated by the fact that the Minnesota law allowed tribal nations to oversee their own grow and sales operations, so some of those businesses have been open for as much as two years already, while non-tribal businesses have had to wait.

When those stores do open, another data point they will have to consider is sales tax. Minnesota raised the cannabis tax from 10% to 15%, and when state and local sales tax are factored in, customers will be facing a more than 20% tax on their cannabis products. For context, Connecticut’s excise tax is 3%, the lowest among states where marijuana is legal, and Washington is the highest at 37%.

Vermont re-evaluates license numbers

Vermont’s first recreational retail cannabis shops opened in 2022. In Vermont, cultivators can grow cannabis anywhere in the state, but the product can only be sold in municipalities that vote to opt-in. Vermont currently has 110 licensed cannabis retailers, 391 cultivators, and 94 manufacturers. Because of the opt-in rules, the towns that allow stores often have disproportionate numbers of dispensaries.

As a result, the state’s Cannabis Control Board is re-evaluating the process for retail license applications. The window for new license applications has been closed for about a year, and cultivation licenses have been paused for about six months. They are now thinking in terms of regional population for retail, and trying to balance supply and demand for cultivation.

Cannabis companies need analytics

Every state faces its own challenges, depending on the regulations they set when they legalize cannabis. It is not unusual for an initial boom to be followed by a downturn or, as Vermont is currently experiencing, to have a need to step in to make sure the market is not over- or under-saturated. For businesses within those states, though, it can be tough to navigate an industry where the playing field shifts, such as they did with tax rates in Minnesota. It’s hard to know what you’re competing against when the competition might be constantly changing, whether that’s in the number of licenses distributed, or to whom licenses are given.

Analytics can help organizations stay one step ahead of changes like these. Companies need the latest information about all aspects of their businesses, and the right analytics solution can help them make the types of decisions that can keep them afloat in times of boom or bust.

The states themselves are using data to make their decisions. Vermont, for example, is hiring an economist to analyze the current market to determine whether more licenses should be given out. Businesses can stay ahead of that kind of work by doing their own analyses and preparing for any possible shifts in their markets.

When it comes to cannabis, analytics doesn’t have to be limited to the financial and regulation aspects of the business. Many companies use technology when it comes to growing the product. A flexible solution can help track the data that creates the best cultivation environments, and allow for experimentation when the market calls for something new.

The right analytics solution can have wide-ranging impact. Some cannabis companies joined forces with beverage distributors to create popular cannabis-infused drinks, forcing the beverage industry to adjust. For a still-nascent industry like cannabis, that’s an indication that despite all of the challenges that come along with the varying regulations, there is still a lot of potential growth that companies can find. To take advantage of those growth opportunities, though, organizations need to arm themselves with the best analytics solution possible to point them in the right direction.

- AI is Available to the Masses. What Does That Mean for Business Intelligence? - February 10, 2026

- How Data Helps Utilities Limit the Damage from Winter Storms - February 5, 2026

- “Where’s the Beef?” How Data Turns AI From Gimmick to Growth - January 27, 2026