The last several years have been a rollercoaster for many industries, including wine and spirits. And as we head into 2023, that rollercoaster will continue. The challenges that the industry is facing include:

- Production prices are rising

- Direct-to-consumer channels are becoming more important for revenue

- Restaurants are still recovering from pandemic closures

In addition, the wine and spirits industry needs to find a way to tap into the buying power of millennials. In order to do so, the industry will have to rely on showcasing its values, augmented reality, and of course, a high-quality product.

As we look ahead to 2023, expect companies to invest in technology, analyze how to reduce production and transportation costs, and invest in partnerships and marketing strategies to capture larger millennial customers as well as direct-to-consumer subscribers.

The cost of wine is going up

In the 2022 holiday season, you spent more on your Thanksgiving turkey, more on the vegetables, and even more on the wine. As a result, inflation has hit your local liquor store.

The wine industry saw a 30% increase in costs in 2022, and multiple factors are to blame. The COVID-19 pandemic didn’t help; shuttering restaurants and wineries drove up prices per bottle.

Every business and industry is dealing with inflation and the rising costs of materials, transportation, and labor. Raising the price of your product is one way to make up for the cost increase. However, some customers, especially cash-strapped millennials, may stop paying up.

Companies will need to employ multiple strategies, such as exploring alternative packaging, analyzing transportation routes, and leaning into premium channels, if they’re to maintain strong profit margins.

The wine market is finally growing

The Global Wine Market accounted for $489.3 billion in 2021 and is estimated to grow to a market size of $825.5 billion by 2030, growing at a compound annual growth rate (CAGR) of 6.1% through 2030.

This industry should receive this projection as encouraging news after a few years of pandemic stress and millennials not buying into the wine industry as their boomer predecessors have.

Fueling the growth is the growing urban inclination for exotic wine, surging demand for alcoholic beverages, and rising consumer socialization with liquors.

Online alcohol sales rose 167% in 2020, leading to more acceptance of liquor consumption socially. In addition, consumers’ desire to travel has increased, and they are seeking activities that serve alcoholic beverages while vacationing. Consumers are also seeking out low-calorie drink options, giving the wine market an avenue to shine.

On-premise wine sales are finally recovering from the pandemic

Where people bought their wine drastically changed during the pandemic. Instead of getting a glass of wine at a bar, consumers bought bottles at the grocery store.

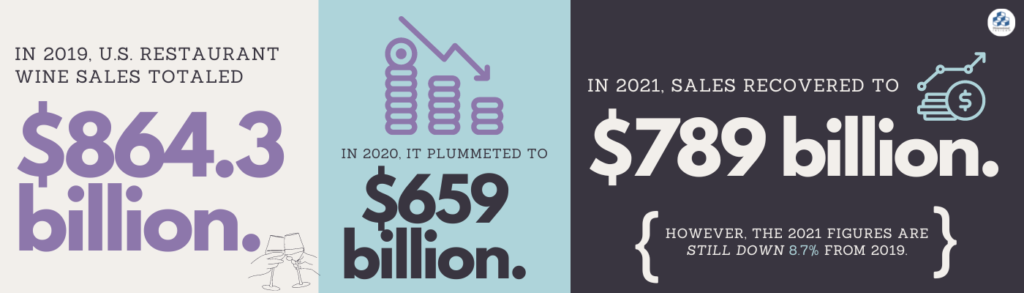

In 2019, U.S. restaurant wine sales totaled $864.3 billion. In 2020, it plummeted to $659 billion. In 2021, sales recovered to $789 billion. However, the 2021 figures are still down 8.7% from 2019.

While it’s encouraging to see the rebound, the tension point is if restaurant wine sales continue to grow rests in the price per glass. The cost of wine bottles in grocery stores remains the same, but the price of a glass or bottle of wine continues to increase when dining at a restaurant. Consumers have noticed that widening gap, and many have decided they don’t want to pay the markup.

According to Nielsen calculations, the restaurant industry’s average cost for alcohol is about $1.02 for a 12-ounce serving of beer, $0.88 for a 1.45-ounce serving of spirits, and $1.51 for a 5-ounce pour of wine. That makes the cost of wine 72% more expensive compared to spirits at a restaurant.

If restaurants continue the markup, wineries will need to rely more on tasting rooms, off-premise sales, and DTC channels.

Virtual reality & and living wine labels

During the height of the COVID-19 pandemic, most customers used their phones to scan QR codes and read menus. But now wine labels are using that habit to provide extra entertainment and help your glass of wine come to life.

Emerging wine brand 19 Crimes utilizes QR codes that customers can scan to unlock a historical mystery based on British prisoners sent to Australia for one of 19 different crimes. Through augmented reality, customers can then listen to the prisoner tell their story in their own words. The brand refers to these as “living wine labels.”

This may sound like a fancy gimmick, but wine labels and producers need new tactics to increase millennial wine consumption.

Millennials are consuming far less wine than their baby boomer predecessors. And unfortunately, the news gets even worse — millennials are less loyal to brands, with only 24% knowing what they were going to buy before walking into the store.

For brands looking for a new way to capture the fickle millennial market, it will take some innovation and money to create this augmented world and bring it to life. According to the ITRrex group, a typical augmented reality app will cost between $25,000 and $35,000, taking two or three months to develop. While augmented reality may require an upfront investment, it could end up paying dividends for an organization.

DTC on the rise

Direct to Consumer (DTC) wine sales became an integral part of wineries’ ability to survive during the pandemic. However, once tastings rooms reopened, Silicon Valley Bank’s annual State of The Wine Industry report predicted DTC prices to remain stable and the share of total sales to either stay steady or perhaps decrease.

However, sales stayed strong and prices actually increased.

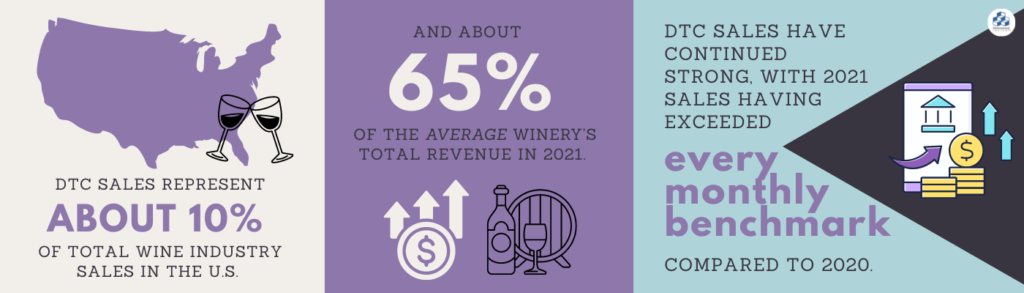

Today, DTC sales represent about 10% of total wine industry sales in the U.S. and about 65% of the average winery’s total revenue in 2021. DTC sales have continued strong, with 2021 sales having exceeded every monthly benchmark compared to 2020.

A recent ShipCompliant report stated the value of the winery DTC sales channel totaled $4.2 billion, driven by an 11.8% increase in average price per bottle on 8.5 million cases shipped from American wineries.

The success shows DTC is more than a trend and is becoming a mainstay in total revenue for wineries in the United States.

DTC growth is somewhat tempered by local state laws that ban DTC shipping. However, states such as Delaware are looking to end this ban soon. If they end the ban, Mississippi and Utah will be the only remaining states completely outlawing DTC alcohol shipping. Arkansas, Delaware, and Rhode Island allow on-site shipments but not off-site shipments.

Conclusion

Wineries and distributors have an exciting year ahead to showcase what they do best, which is to make and sell good wine.

However, each segment of the industry has to reconcile with rising costs, whether that’s the rising cost of a glass at a restaurant or production costs.

2022 brought lots of promising news and growth for the wine industry, setting the industry up for a strong 2023 as long as they adapt based on the story the data is telling them.

Interested in learning more? Check out our full white paper—”5 Trends Impacting the Wine & Spirits Industry in 2023.”

- How Spirits Brands Can Improve Brand Loyalty with Data Analytics - January 30, 2024

- The Collapse of Herbl, and How Other Cannabis Distributors Can Avoid the Same Fate - January 24, 2024

- Top 5 Blog Posts of 2023 - December 28, 2023