The beverage alcohol industry saw a big shift in consumer consumption over the last two years, as quarantine and social distancing guidelines led more people to drink at home as opposed to in restaurants. However, with many of these restrictions now lifted, many in the industry are wondering what the future holds for on- and off-premise channels, as well as the e-commerce channels that took off in popularity. Let’s examine the changes ahead for the industry.

Transition from on- to off-premise

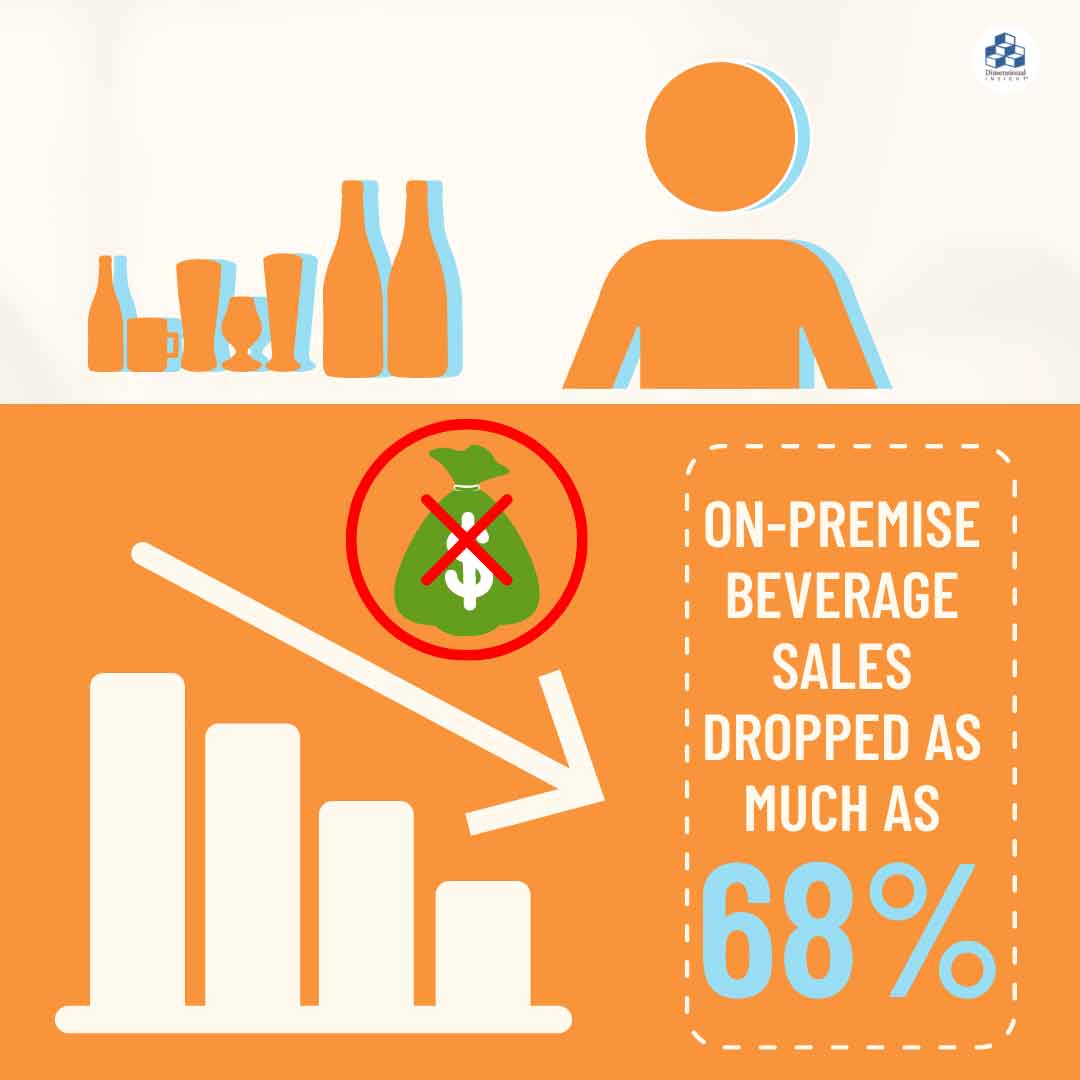

The lockdowns of the last two years forced most restaurants, bars, and other drinking establishments to shut their doors to the public, some permanently. Although some establishments managed to find alternative routes to stay afloat (cocktails-to-go, prioritizing food orders, etc.), many were forced to watch as their customers turned to drinking at home. Analysts at NielsenIQ found that on-premise beverage sales dropped as much as 68% during April of 2020 from the same time the year before.

Confined to their homes and granted with excess personal time, many people experimented with new at-home occasions for drinking. Part of this can be attributed to younger consumers who, motivated by lower income and advancements in technology, have grown comfortable with staying at home and relying on digital platforms for everything from shopping to dating—activities that were once centered around the on-premise.

Even with the significant downturn in on-premise sales, alcohol consumption as a whole continued to increase throughout the pandemic as consumers turned to drinking as a less-than-ideal coping mechanism.

The emergence of new channels

Although the pandemic all but muted the on-premise industry, lockdown orders, coupled with relaxed shipping and distribution laws, fueled an unprecedented growth in ecommerce sales. According to data from NielsenIQ, online wine sales spiked 234% during the pandemic in 2020. Although many digital platforms witnessed the majority of their growth during the initial stages of quarantine, their success has continued to carry over into even the present-day.

For many brands, direct-to-consumer (DTC) channels provided a new outlet for bringing in revenue amidst the increasing popularity of mobile and online shopping. DTC wine sales in particular, led mostly by small wineries, saw double digit growth in 2021. Now, more and more states are loosening their regulations surrounding DTC shipping in an effort to capitalize on its success during the pandemic.

Post-pandemic recovery

With most of the population now vaccinated and lockdowns finally lifted, customers are returning to their favorite drinking establishments. However, bars and restaurants still have a long road of recovery ahead. Changes in consumer behavior induced by the pandemic mean that many establishments will have to adapt their strategies in appealing to potential customers.

Digital branding & engagement:

- One of the biggest trends highlighted during the lockdowns it the important of digital branding and engagement. The reliance on ecommerce and virtual platforms due to quarantine has led many individuals to value how businesses present themselves and interact with their customers on websites and social media. This means that on-premise establishments will have to invest in quality web-design and digital marketing efforts if they wish to retain many of their returning customers.

Adapting inventory:

- Furthermore, the changes in how consumers were drinking during the pandemic also influenced what they were drinking. Already growing in popularity amongst younger demographics prior to the pandemic, hard seltzer sales skyrocketed during quarantine, growing a whopping 130% in 2020 alone.

- On top of the recent surge in hard seltzer sales, the pandemic also fueled a growing preference for premium products as consumers opted to treat themselves more often. With customers now accustomed to higher quality products and an increased demand for local and craft flavors, on-premise establishments will have to adjust their inventory to reflect the new market trends.

Improving business ethics:

- Although not directly related to the pandemic, 2020 and 2021 also witnessed a demand for improved business ethics as protestors turned to the streets and social media in support of social justice campaigns. Now, many consumers (particularly millennials and Gen Z) are actively pursuing establishments that share their overall values and demonstrate sustainable and inclusive business practices. Likewise, some venues have faced substantial backlash from the public for reasons such as racist dress-codes or political affiliation.

Learning more

Although the pandemic was a huge disruption and devastated the on-premise industry, lifted lockdowns and dropping case numbers hint towards a brighter future for bars, restaurants, and other establishments. That said, these businesses still have a lot of changes they have to make if they are to persevere in the post-pandemic world. To learn more about what to expect from the future of the beverage industry, check out our whitepaper—”5 Trends Shaping the Wine & Spirits Industry in 2022.”

- How Spirits Brands Can Improve Brand Loyalty with Data Analytics - January 30, 2024

- The Collapse of Herbl, and How Other Cannabis Distributors Can Avoid the Same Fate - January 24, 2024

- Top 5 Blog Posts of 2023 - December 28, 2023