Silicon Valley Bank’s collapse has brought scrutiny upon the banking industry. Investors’ fears about banking caused dips in stock markets around the world, and there have been reactions from a number of other industries, including in wine country.

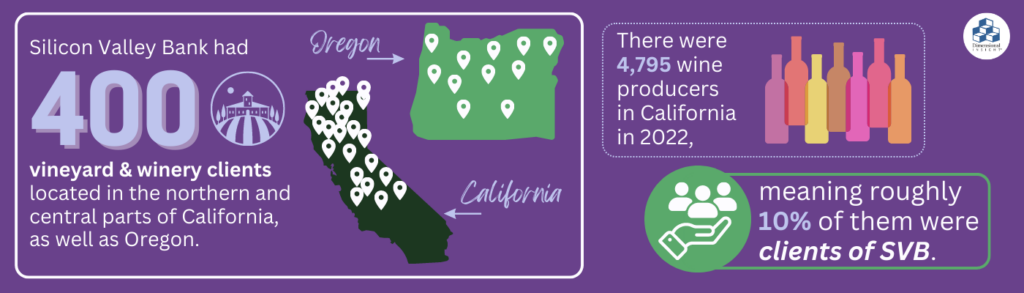

Before its collapse, Silicon Valley Bank (SVB), the 16th largest bank in the United States, had 400 vineyard and winery clients located in the northern and central parts of California, as well as Oregon. According to Wine America, the National Association of American Wineries, there were 4,795 wine producers in California in 2022, meaning roughly 10% of them were clients of SVB.

Back in 1994, executive vice president Rob McMillan, who founded Silicon Valley Bank’s unique Wine Division, said in an interview, “We understand the wine industry and its particular kinds of risks. We have deep expertise. Some employees were former winemakers with MBAs; some even volunteered regularly to work the harvest at wineries. These are family businesses.”

So it’s easy to understand why wineries would have wanted to bank with SVB. The overall theory of the bank was to take risks on up-and-coming businesses, and the wine industry had the appeal of hard assets such as land, buildings, and equipment.

Winemaker Adam Lee, the founder of Siduri and Clarice Wine Co. in Sonoma, posted a letter on Clarice’s website shortly after the news about SVB broke, about how the bank’s wine department helped his company.

“Ask me a week ago, and I would have said that SVB was one of the smartest and most stable financial institutions in the world,” he wrote. “Little did I know that things would collapse within less than 48 hours.”

Vineyard owners panic

The wine industry has had a tumultuous few years dealing with everything from climate change to COVID-19, but a bank failure is a new and unexpected hurdle.

Connor McMahon, the owner of Fulldraw Vineyard in Paso Robles, California, told Bloomberg News that when he heard of SVB’s collapse, he panicked. It took 30 minutes to be connected with a bank loan officer, who told him it was too late to move his money from the SVB checking account to another bank because the FDIC had already taken over and shut down the bank’s systems.

On top of his money in checking, McMahon had previously secured a five-year loan at 2.25% interest in 2021 through SVB to build Fulldraw’s new winery. But with today’s rates, he says, he fears his loan will be closer to 6.5%, which would cause “a monumental change for our business.”

Clarice Wine’s founder Lee wrote more on his website about the interest Chris Roach from SVB took in his wines.

“Over the years, Silicon Valley Bank and the many people that worked with us there became more than a bank. They became partners in our growth as a winery and as winemakers. Harvest after harvest, Silicon Valley Bank employees would come over on a particularly busy day and help us sort grapes. They’d bring us lunch and spend hours – literally hours – standing at the sorting table with us, separating out leaves and damaged clusters.

“Honestly, I am going to be fine. The FDIC is going to cover my money and really the process of opening another account at another institution isn’t difficult…except that it makes me feel like I am not being faithful to the bank that allowed me to become the winemaker that I am today.”

In a later interview with Bloomberg, Lee said that Silicon Valley Bank’s closeness with those in the industry meant “those wineries are quite exposed.”

How wine owners can protect themselves moving forward

The government took over SVB early to avoid panic and a run on banks. While the overall banking system is secure, small business owners need to look at where their money is to protect themselves.

Some key lessons learned from the SVB collapse include seeing if you have more than $250,000 — the FDIC-insured limit — in any one bank. If you do, consider moving some money to a different bank to diversify where your holdings are. This way, if another regional or mid-size bank runs into trouble, you have access to some funds.

You can also consider adding beneficiaries to your account, as FDIC tends to cover $250,000 per beneficiary, therefore allowing you to have more money in one account with more protection.

- 87% of Utilities Have Experienced at Least One Data Breach in Last Three Years - February 5, 2024

- Can Drones Lower Your Next Utility Bill? - January 10, 2024

- Onshore Wind Farms Are The Next Big Thing In Renewable Energy - December 6, 2023