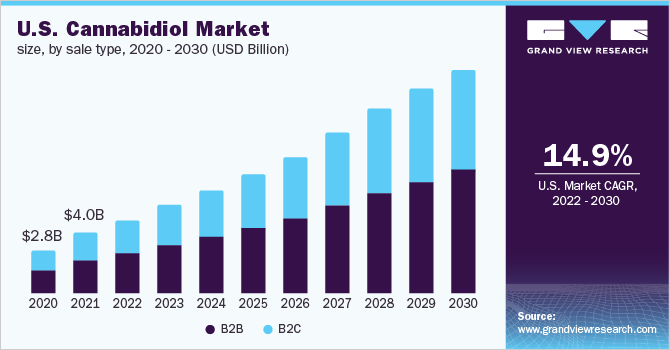

CBD beverages have become increasingly popular in recent years amidst a renewed interest in personal health and wellness, especially in the wake of the COVID-19 pandemic. According to a report from GlobalNewsWire, the CBD market size was valued at $9.1 billion in 2021 and is expected to reach $59.3 billion by 2030.

As with the recent surges in RTD-cocktail and hard seltzer sales, capitalizing on the success of the CBD-beverage market requires understanding just what exactly about it is drawing consumer attention.

What’s CBD?

CBD, or cannabidiol, is a naturally occurring chemical derived from cannabis, otherwise known as marijuana or hemp. Similar to THC, CBD is known for its calming and sedative effects. However, unlike THC, CBD isn’t psychoactive and doesn’t produce a “high” in those who consume it. This means users can reap the healing benefits of cannabis without worrying about being intoxicated (although it can produce other side effects, such as drowsiness or fatigue).

Futhermore, a growing body of evidence from researchers indicates that CBD may be useful in treating a variety of ailments such as depression and anxiety, nausea, PTSD, insomnia, MS, epileptic seizures, and cancer-induced pain. As a result, CBD has become very popular in consumer products like lotions, foods, oils, cosmetics, and of course, beverages.

The rise of CBD-infused beverages

One of the most popular and convenient mediums for CBD consumption is RTD beverages. Unlike other methods of use, the one-and-done nature of RTD beverages allows users to enjoy its benefits without committing to something more expensive and long-term, such as tinctures and oils.

Furthermore, CBD has gained additional traction due to its unique niche in low-ABV drink selections, as it can provide the slight boost to one’s mood that drinkers may want without the adverse side-effects associated with alcohol. Hemp’s unique flavor profile also makes it an easy alternative for consumers who enjoy the bold flavors found in hoppy beers and cocktails.

The legalization of hemp farming at the federal level has also allowed CBD to become much more widely available. Major beverage companies such as Molson Coors, Breakthru Beverage, and PepsiCo are now expressing interest in breaking out within the new market. Currently, store shelves are dominated by mostly smaller wellness-oriented brands, meaning consumers have a wide variety of formats and flavors to choose from, including sparkling waters, teas, coffees, and sports drinks.

What this means for distributors and suppliers

According to a report from IWSR, the no/low alcohol market in the US was valued at approximately $2.2 billion in 2022, and is currently still growing amidst increased demand from consumers for healthier drinking options. Within the no/low space, the alcohol-adjacent market (which includes CBD-infused beverages) in the US was valued at around $98 million.

The rise of CBD beverages (and alcohol adjacencies in general) is occurring at a time when beverage companies are ramping up their approach to non-core product categories. Experimenting with previously foreign marketplaces has become crucial for long-term growth, especially given the recent diversification of soft drinks and beer companies.

CBD beverages benefit from some of the same marketing angles already present in the alcohol industry, with both CBD and alcohol advertising themselves as a way to help consumers relieve stress. At the end of the day, these beverages rely on messaging related to their role as mood-enhancers. While CBD beverages may be free of alcohol, they can still be used to target alcohol-related occasions.

Product innovation also follows a similar path between the two categories, with brands focusing on discovering which ingredients can be leveraged to produce mood-altering effects while still offering an appealing flavor profile.

Learn more

Curious about other trends in the beverage industry? Check out our white paper—”5 Trends Impacting the Wine & Spirits Industry in 2023.”

- How Spirits Brands Can Improve Brand Loyalty with Data Analytics - January 30, 2024

- The Collapse of Herbl, and How Other Cannabis Distributors Can Avoid the Same Fate - January 24, 2024

- Top 5 Blog Posts of 2023 - December 28, 2023