It can be easy for an outsider to sit back and identify trends in an industry. With the luxury of distance, someone can take the time to look at the big picture and report after the fact on what is happening.

When you’re in that industry, though, you often need to react more quickly. That’s where real-time data can help identify trends as they are unfolding so a company can make an adjustment to avoid a problem or to take advantage of an opportunity. In the cannabis industry, there are new tools becoming available all the time that can help make sense of that data. Here’s what organizations need to know about identifying trends and figuring out what those trends can mean for them.

Industry trends for the new year

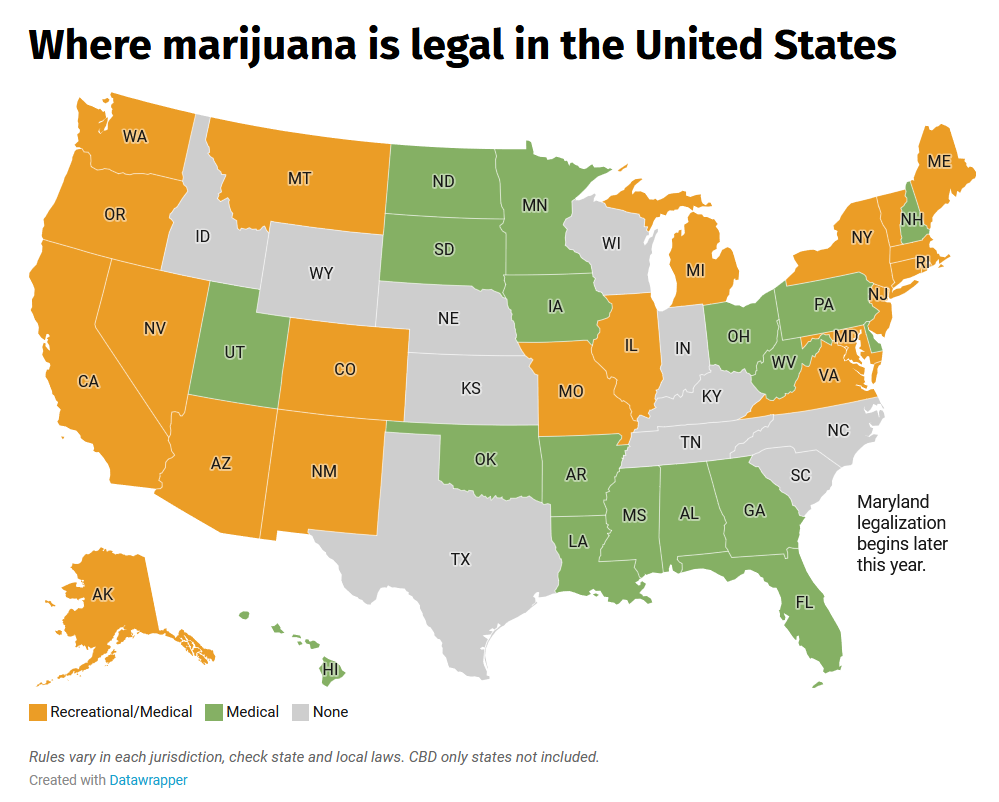

Every industry uses the new year as a benchmark, where organizations can get a sense of what to expect over the next twelve months. The cannabis industry sees those same predictions, with one important distinction: it is consistently identified as one of the world’s fastest-growing industries. In the United States, the industry is growing as more states legalize recreational marijuana each year.

That designation is more than just a trend itself – it is a reason for other trends within the industry. The addition of new markets and new regulations that are unique to each state, while the industry at the federal level remains illegal, contributes to the overall volatility of the cannabis trade. And all of that is a reason why there are more and more interested parties when it comes to learning more about the trends and how to establish a foothold in the industry.

2023 so far

One of the trends industry insiders said to watch out for in 2023 was related to that industry volatility. Mergers and acquisitions were always a part of the cannabis industry as established players scooped up other promising organizations to help the established businesses operate across multiple states. Those deals could involve a smaller organization looking to cash in, or it could be a last gasp by a small business to try to stay afloat.

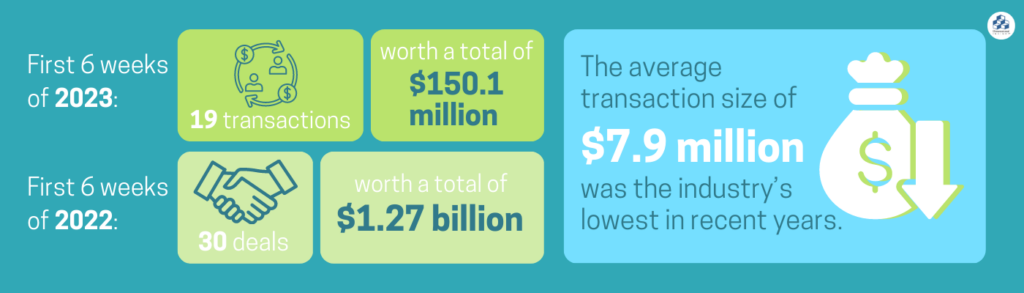

In the early months of 2023, the idea that there would be a continuation of this kind of consolidation is ringing true. However, another projected trend is also appearing prescient. The value of some deals was declining in 2022, and experts predicted that would continue in 2023. Through the first six weeks of the year, the cannabis industry saw just 19 transactions worth a total of $150.1 million, according to data collected by Viridian Capital Advisors. Through the first six weeks of 2022, there were 30 deals worth $1.27 billion. The average transaction size of $7.9 million was the industry’s lowest in recent years.

How to navigate the data

What do those numbers mean to the average cannabis business? It’s an indication of how much money is being invested into the cannabis space. The result is not surprising to those following the industry. The trends indicate that although the industry is still set to grow as a whole in the near future, a glut of supply right now will make things difficult for smaller organizations in the near-term.

That’s why it’s important to find the right analytics solution that can identify the trends and help an organization navigate them. The data can indicate everything from, as we’ve seen, the money being invested in the industry, to which regions are seeing the biggest influx of cash. It can also break down industry sectors to help organizations know what areas are most likely to make money in what could be an economically difficult time. The answers could lie in pricing, or the numbers could indicate there is something in the cultivation stage that could make a difference.

It can be tough for organizations to know whether or not to invest in analytics software when the industry is so uncertain. Smaller organizations especially might have a tough time allocating money towards analytics when they are pulled in so many directions when it comes to spending. But when it comes to who is most in need of data that can identify trends, it is those smaller organizations that could see the biggest benefit from exactly that type of investment.

- Summer is an Opportunity for Digital Transformation in Education - April 17, 2024

- Your Car is Tracking More than Miles per Hour - April 11, 2024

- Data Can Help Provide Equal Footing in Cannabis Space - April 3, 2024