With the introduction of White Claw in 2016, the world saw a sudden explosion in demand for hard seltzer products. The category saw tremendous growth over the next couple of years, quickly becoming one of the fastest-selling RTD (ready-to-drink) beverages in stores. Already experiencing success across the country, hard seltzers catapulted into astronomical levels of expansion during the COVID-19 pandemic, growing a whopping 130% in 2020 alone. Although these numbers will eventually slow as the category matures, hard seltzers are still showing promising signs of potential opportunities within the industry.

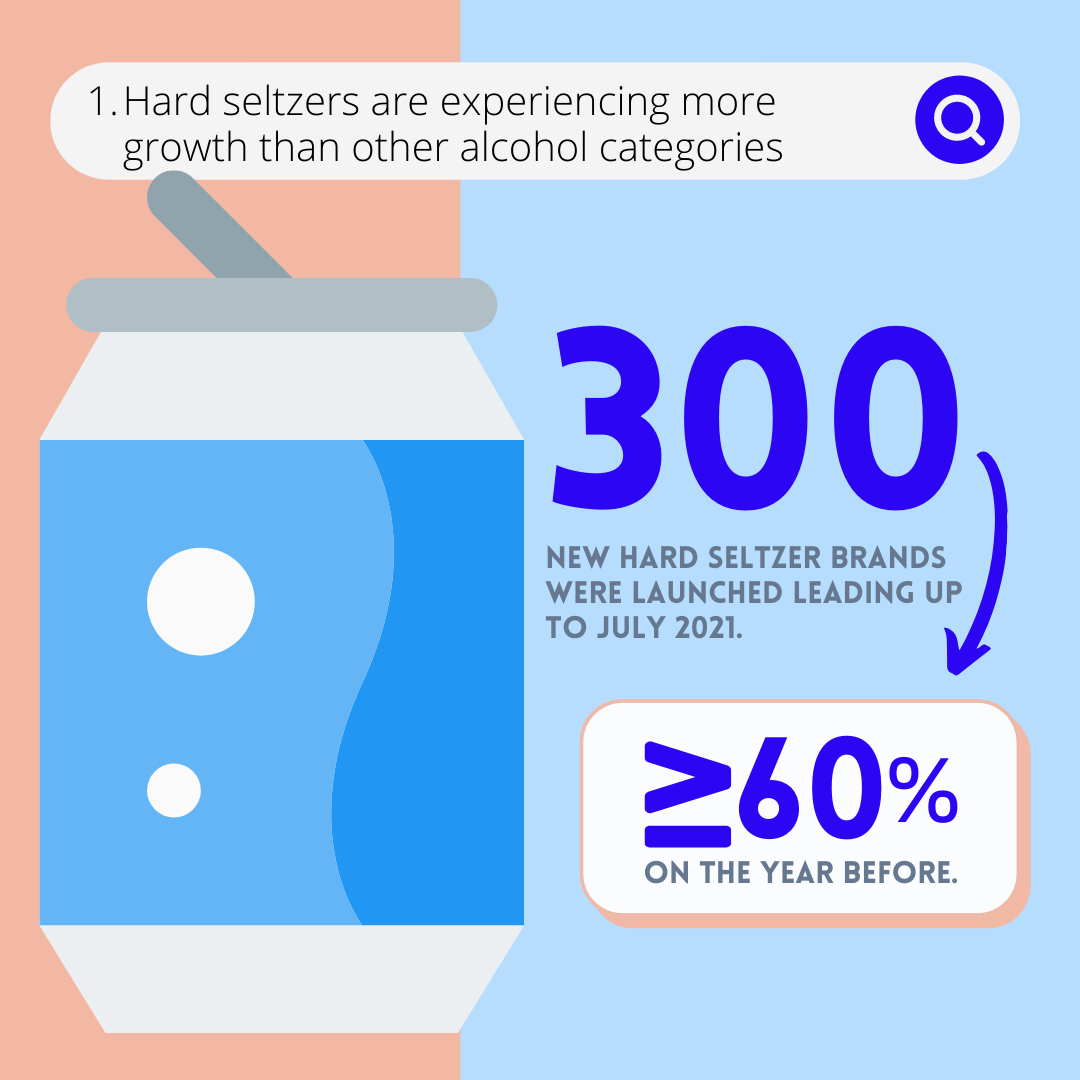

1. Hard seltzers are still experiencing more growth than other alcohol categories

Hard seltzers (and RTDs in general) are still growing at a significantly greater rate than most other alcohol categories in the U.S. According to the IWSR, almost 300 new hard seltzer brands were launched in the year leading up to July 2021 in the U.S., up more than 60% on the year before. Even though the triple-digit growth seen in 2020 isn’t sustainable long-term, the hard seltzer category has proven itself to be more than just a trend and is here to stay.

One of seltzer’s greatest strengths compared to other RTD options and beer is its unparalleled versatility. On top of being able to deliver alcohol to a wide variety of palates, hard seltzers are also easily adaptable to current trends like premiumization and health and wellness. This makes them ideal for the fast-paced culture of the modern digital age.

2. Everybody wants a piece of the pie

The unparalleled success of hard seltzers has attracted attention across the alcohol and beverage industry. Companies across the spectrum from Mountain Dew to Bud Light have introduced their own lines of products in an attempt to capitalize on the market’s recent success. Even Hallmark—better known for its iconic greeting cards—announced its own Cheers Rosé Seltzer for National Wine Day back in May of 2020. The fast-paced nature of such an explosive market means many trends within the industry are short-lived. Poorly selling products are quickly removed from shelves as businesses make subtle changes to reflect the ever-changing demands of their consumers.

Meanwhile, other seltzer-like RTD products have also started to gain traction as spirits brands look to take advantage of the recent market trends. Partially to blame for the hard seltzer category’s slowing growth, RTD cocktails provide consumers with another option for convenient and health-conscious drinking. Vodka, with its relatively neutral flavor profile, has seen particular success as a base within RTD beverages.

3. Premiumization is the future

As with many other RTD categories, hard seltzer brands are looking to premiumization to maintain relevance with their consumers. Across the industry, companies are now prioritizing quality over quantity. Larger established brands like White Claw and Truly are continuing to build upon the market’s recent growth by expanding their portfolios with new flavors and variations in alcohol content.

Meanwhile, smaller brands are capitalizing on the recent interest in craft products by placing an increased emphasis on local flavors and small-batch producers. Driven by a mostly millennial consumer demographic, the category has also witnessed a significant increase in healthier beverages along with more sustainable business practices.

The demand for more premium products has also driven a surge in spirit-based seltzer-like drinks. Building-upon the same consumer trends as hard seltzers, RTD cocktails provide an alternative to malt-based beverages for those seeking a more premium drinking experience. The introduction of spirit-based RTD options has allowed many businesses to expand into drinking occasions that hard seltzers have traditionally struggled to gain traction in. According to data from IWSR, spirit-based RTDs accounted for 40% of SKUs of all RTD products launched in the U.S. in 2020.

4. Sales are mostly driven by younger consumers

The unprecedented growth of the hard seltzer category can mostly be attributed to its popularity within the younger consumer base. More health conscious than prior generations and desiring a lighter product than beer or cocktails, millennials and Gen Z quickly adopted hard seltzers as one of their primary go-to alcoholic beverages. While many other alcohol categories are also experimenting with lower- or even zero-ABV options, seltzers already had a strong foundation in the market with the established success of sparkling water.

Furthermore, the category’s increasingly innovative packaging and low price tag satisfies the younger generations’ need for a more convenient and versatile drinking experience, especially when compared to traditional mixed beverages. With such a large spectrum of flavors and styles available, hard seltzers are able to easily adapt to a variety of formats and occasions, and continue to experience success year-round.

Future market opportunities

Although hard seltzers may not reach the same levels of growth seen during 2020, the category is still loaded with potential. In order to capitalize on this unique opportunity, it’s critical that businesses continue to use effective data analytics solutions to track and predict key market trends. To learn more about the current state of the beverage industry, check out our whitepaper—”5 Trends in the Beverage Alcohol Industry for 2021.”

- How Spirits Brands Can Improve Brand Loyalty with Data Analytics - January 30, 2024

- The Collapse of Herbl, and How Other Cannabis Distributors Can Avoid the Same Fate - January 24, 2024

- Top 5 Blog Posts of 2023 - December 28, 2023