During the pandemic, there have been two types of wine drinkers: those seeking to create a restaurant experience at home with premium wine or liquor, and the customer searching for a value-driven product that tastes good but doesn’t cost much.

Many people still face unemployment and need to be conscious of the price point at which they purchase their alcohol; others are redistributing to premium liquor funds they previously spent at concerts or other pre-pandemic activities.

These price points will continue to diverge, with the premium sector growing, but many customers still want liquor stores and retailers stocked with varied price point selections.

So where does that leave brands priced at the mid-point?

The rise of premium

The customer’s desire for premium products shows in the stats.

Shem Blum, Flor de Caña’s senior brand manager, told Penta that the company’s higher marque products, those aged more than 12 years, are up 41% this year. With those staggering sales, Flor de Caña’s distribution partner William Grant & Sons built out a new team of luxury ambassadors focused on continuing to grow their premium products online and in person.

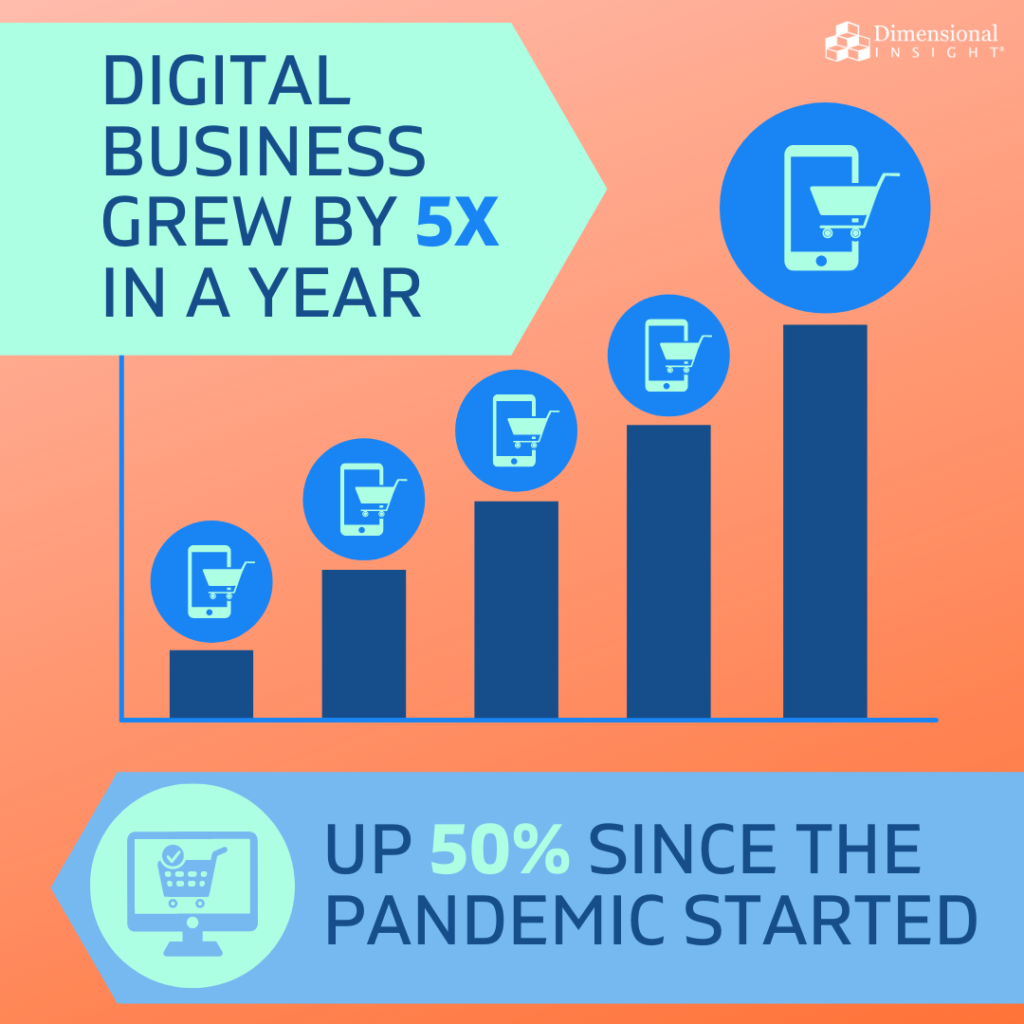

Patrón Tequila’s vice president of marketing Adrian Parker also highlighted growth not just across the product range, specifically in their Gran Patrón line ($200-$400 range). The brand’s digital business grew by 5 times in a year and is up more than 50% since the pandemic started.

“Though overall, discerning consumers may be drinking less, they are certainly drinking ‘better’ as they continue to seek out premium products,” Jim Brennan, senior vice president, malts and innovation brands at Edrington, told Penta. “Interestingly, any on-premise drop was largely balanced with an increase in off-premise for The Glenrothes core products, specifically.”

Rob McMillan, who writes the Silicon Valley Bank’s annual wine industry report, told The New York Times that “in the short term, the coronavirus pandemic might benefit the premium wine industry,” with data showing locked-down consumers “willing to spend up,” perhaps as they try to recreate the restaurant experience at home.

Goodbye midpoint prices

Seeing trends that reflect the rise of premium spirits but also the customer desire for affordable options can feel confusing. What this means is anything priced between premium and value-driven products will suffer sales losses.

The hot rosé market has already begun a consolidation, with major brands such as Moët Hennessy buying Whispering Angel’s producer. Production of this customer-favorite wine will snuff out the competition on the already packed rosé shelves.

Millennials resisted premium wines even before the pandemic began, choosing to explore new concoctions such as CBD-infused products, locally crafted brews, or cocktails in a can.

“Baby boomers, who control 70% of U.S. discretionary income and half of the net worth in the U.S., are moving into retirement and declining in both their numbers and per capita consumption, while millennials aren’t yet embracing wine consumption as many had predicted,” Silicon Valley Bank’s 2020 report said.

However, with a national unemployment rate still high, many can’t justify purchasing high-priced wine.

“After Sept. 11, 2001, terrorist attacks, and the 2008 financial crisis, the luxury wine market took painful hits. In such times, people don’t stop drinking; they just buy less of the expensive stuff,” McMillian told The New York Times.

How brands can respond to customer demand

For brands feeling confused about how to play to the premium market, copy what others are doing—go online.

Pernod Ricard CMO Pamela Forbus told Penta, “In the midst of the pandemic, digital commerce adoption projected to take more than three years occurred in the span of less than nine weeks.”

Some brands chose to explore digital growth through influencers, while others developed e-commerce strategies to help “off-premise” sales rise when on-premise drinking wasn’t an option.

If you’re a winery that previously relied on tasting room sales, pivot to allow customers to pick up cases of wine with contactless pickup. Employing this strategy helps keep workers employed and customers engaged.

- 87% of Utilities Have Experienced at Least One Data Breach in Last Three Years - February 5, 2024

- Can Drones Lower Your Next Utility Bill? - January 10, 2024

- Onshore Wind Farms Are The Next Big Thing In Renewable Energy - December 6, 2023