When you walk into a liquor store, you’ll see 30 different types of rosés, all at the same price point. A typical customer will buy one, maybe two different types, and stay loyal to the one they chose first when they make their next purchase.

In the last five years, rosé wine became the summer drink of choice. Sales skyrocketed and showed no sign of slowing down.

“Rosé sales in the past year were up approximately 25 percent. No other beverage category grew nearly as quickly,” Aldo Sohm, wine director at Le Bernardin and Aldo Sohm Wine Bar, told PureWow in 2018.

In 2019, sales of rosé wines grew in the United States to 18.7 million cases, according to Shanken’s Impact Databank. But it seems brands feel customers have had too much rosé.

“While the category has been seeing impressive growth, some may wonder if rosé is beginning to peak—or if its upward trajectory will continue,” Kathleen Willcox wrote for SevenFiftyDaily.

Consumers still seem to want their premium rosé during those hot summer months, but expect the excess of cheaper brands on the shelves to start to disappear.

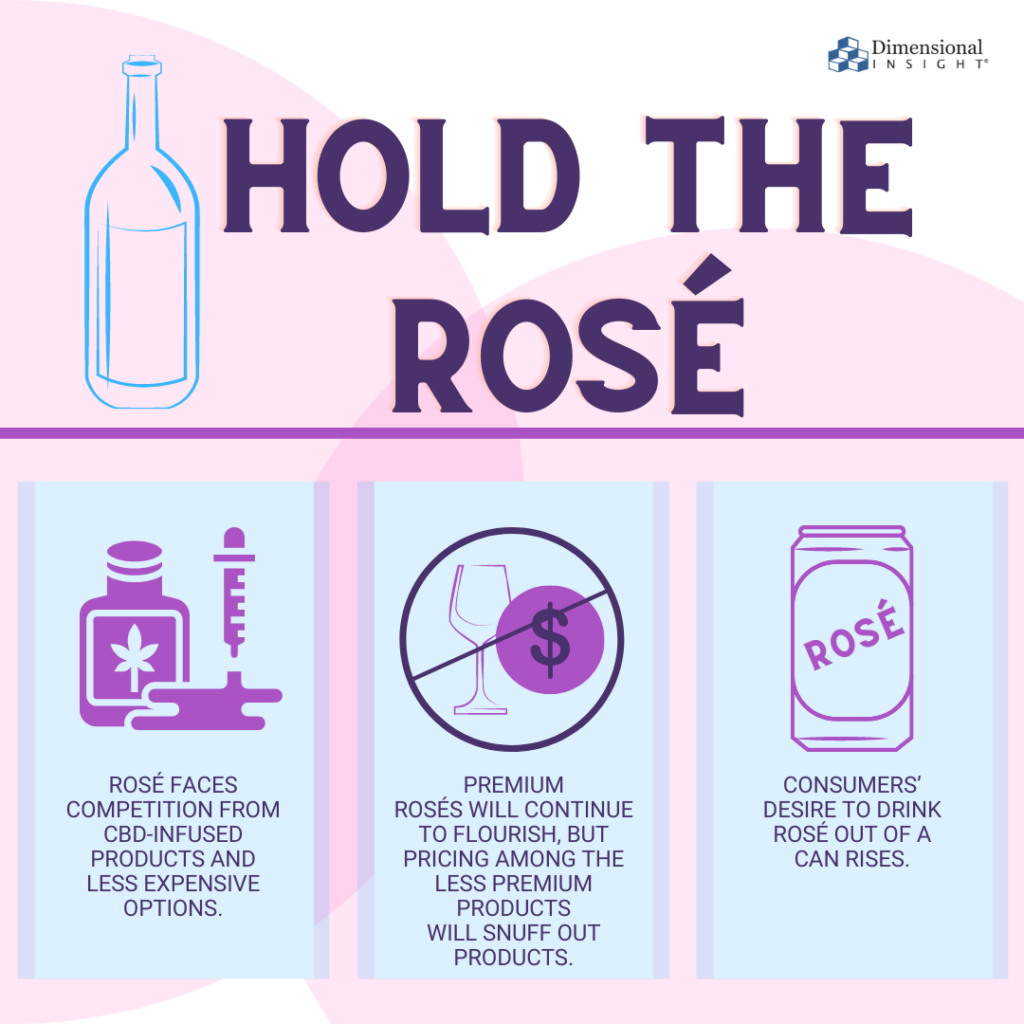

Rob McMillan, the executive vice president and founder of Silicon Valley Bank’s Wine Division, feels rosé faces “serious competition” from CBD-infused products and less expensive options with “similar premium-style taste profiles.”

“Reds and whites from Provence are competing for the same consumer who wants premium but lower-priced wines,” McMillan told SevenFiftyDaily. “Plus, there’s Italian Pinot Grigio and New Zealand Sauvignon Blanc that are also lower-priced, not sweet, and suited for the younger, frugal customer.”

Brands consolidate

Moët Hennessy just bought Château d’Esclans, which produces Whispering Angel. Their goal is to take it to a million-case production. With this deal and the influx of fan-favorite Whispering Angel on the shelves, some consolidation will come in the rosé market.

Constellation brands also consolidated many of their wine brands, claiming that beer and marijuana see more promise than wine.

Premium rosés will continue to flourish, but pricing among the less premium products will snuff out products. European wines face looming tariffs, so if those rosés cost more for the same flavor profile in a United States liquor store, the less expensive but just as tasty wine will win.

Rosé is canned up

While the less expensive bottles of rosé may start dwindling, consumers’ desire to drink rosé out of a can rises.

“The market for cans is exploding right now,” Harmon Skurnik, the president of Skurnik Wines & Spirits, an importer and distributor based in New York City, told SevenFiftyDaily, “and that extends to rosé.”

According to Nielsen data, canned table rosé sales increased 107.9% year over year in May 2019, while sales of canned sparkling rosé increased more than 180%.

Canned wine is “very useful if you’re having a pool party or somewhere with a refrigerator or cooler; it travels well, and it makes sense,” Sarah Clarke, Beverage Director of Mozza Restaurant Group, told Shondaland.

What brands can do to keep customers reaching for rosé

For brands that have an extensive portfolio of rosés, consider promoting the more premium products and transitioning your other products to canned rosés.

“Very light wines that are super versatile will continue to grow. They’re wines you can put a chill on. People who were typically grabbing rosé or contact orange wines are moving towards crunchy red wines — domestic or imported; it doesn’t matter,” Ryan Bailey, wine director of The NoMad Hotel in Los Angeles, told Shondaland.

- 87% of Utilities Have Experienced at Least One Data Breach in Last Three Years - February 5, 2024

- Can Drones Lower Your Next Utility Bill? - January 10, 2024

- Onshore Wind Farms Are The Next Big Thing In Renewable Energy - December 6, 2023