CFOs are paid to think strategically, identifying profitable opportunities and creating new business models. Yet in reality, they still spend too much of their time on nuts and bolts accounting, which distracts them from the strategic work that could help grow corporate profitability and remain ahead of competitors.

One reason for this disconnect lies in the area of revenue and expense reporting. Despite significant technological advances in budgeting, forecasting and compliance, revenue and expense reporting is still a time-consuming manual process that saddles the finance department with inefficient and unnecessary workloads.

In this blog post we’ll look at three major expense and revenue reporting challenges that face CFOs.

1. Too much time is spent on inconsistent and error-prone GL reporting

In any business, departmental and product managers are held accountable for performance against budget. The CFO and the finance department “own” an organization’s general ledger (GL), which tracks expenses against budget. Finance generates canned reports from the GL showing summarized financial data and individual performance against budget. The departmental managers outside of finance view these reports, look for variances, and take corrective measures to eliminate cost overruns and maximize budget efficiency.

The problem is that when a significant budget deviation is identified, the summarized data in the GL report doesn’t provide enough detail to understand root causes. A departmental manager will often want the underlying details behind the GL summaries — the specific transactions that caused them to overshoot their budget. Each variance typically triggers a flurry of activity to find the underlying transaction detail. Either the departmental manager (or her staff) must query the source system, or, commonly, a request goes back to the finance department to run additional one-off reports of transaction details.

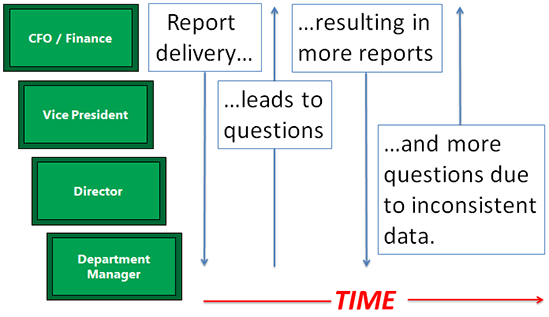

This workload tends to spike immediately after the close of each financial reporting period. If that period is monthly, the workload for finance hardly ever stops. Executives email questions to finance, and once they receive answers, they usually have even more follow-up questions. It could take weeks before an issue is satisfactorily resolved.

CFOs face the dilemma of inconsistent, time-consuming reporting between Finance and Operations

2. Where is the data, and who can access it?

A second problem stems from the way that organizations store financial data. Transactional details from ancillary systems such as Payroll, Inventory Management and Accounts Payable that roll up to the general ledger are aggregated before being posted to the GL as journal entries. The end result is that the GL contains none of the rich transactional detail that is necessary for investigating and understanding the root causes that drive a budget deviation or worrisome uptrend in a particular expense category. This means that in addition to finance, IT often gets tasked with requests for data extracts from these transactional systems, since few if any of these ancillary systems are owned by the finance department.

Access privileges and data security play a significant role here as well. Safeguards must be put in place to ensure that directors and managers are only allowed to view the information relevant to their employees. Little wonder that it can sometimes take weeks to answer a single question.

3. How can I easily compare my managers without resorting to spreadsheets?

Thirdly, the reports generated by the finance department are income statements and balance sheets. These reports display profits, losses and performance against budget for an individual director, manager, brand or product and are certainly useful. But a director with 30 department managers reporting to her must view 30 individual reports. Worse yet, in order to compare the relative performance of those managers, she must resort to a fair amount of manual spreadsheet work copying, pasting and transposing report rows into spreadsheet columns. Ideally, the GL should be able to generate the needed report, sparing directors and VPs this time-consuming and error-prone spreadsheet work.

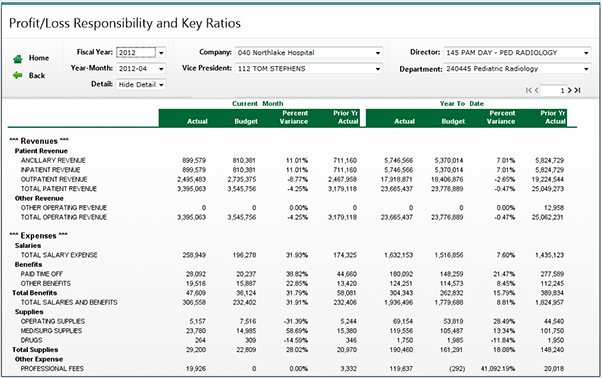

A P/L report showing line item performance data for one Department

Organizations need solutions to get the most out of their GL

So how can an organization overcome these issues, short of replacing their general ledger with the latest ERP system or accounting software? It’s not unusual for GL software to have a useful lifetime measured in decades rather than years. This explains why so many corporations still run on legacy ERP systems such as JD Edwards and Harris. Replacing or upgrading a GL is akin to performing open heart surgery on a patient who is in the middle of running a marathon.

Rather than incurring the significant business disruption, cost, and resource commitments to replace an existing GL, organizations can adopt low-risk, high-reward solutions that bring GL reporting and analytics up to speed while leaving their existing GL in place.

In my next blog post, I’ll examine the pivotal role that self-service business intelligence (BI) can play in automating revenue and expense reporting and how analytics can dramatically shorten the ask-to-answer loop between finance and business management. I’ll also discuss some real-world examples showing how BI can provide CFOs with critical insights into smarter expense management and line managers with opportunities for managing performance and profitability more effectively.